Rising Shipping Activities

The Ballast Water Treatment System Market is poised for growth due to the rising shipping activities across various sectors. The expansion of global trade and the increasing number of vessels in operation are contributing to a higher demand for ballast water treatment solutions. According to industry reports, the number of ships requiring ballast water treatment systems is projected to increase significantly, driven by the need for compliance with international regulations. This surge in shipping activities necessitates the installation of effective treatment systems to manage ballast water responsibly. Consequently, manufacturers are likely to benefit from this trend as they develop and supply innovative solutions to meet the growing market demand.

Technological Advancements

Technological advancements play a pivotal role in shaping the Ballast Water Treatment System Market. Innovations in treatment technologies, such as ultraviolet (UV) light, electrolysis, and filtration systems, are enhancing the efficiency and effectiveness of ballast water management. These advancements are crucial as they enable vessels to meet stringent regulatory requirements while minimizing operational costs. The market is witnessing a shift towards more automated and user-friendly systems, which are expected to capture a larger share of the market. Furthermore, the integration of digital technologies, such as IoT and AI, is likely to optimize the performance of ballast water treatment systems, thereby driving market growth.

Regulatory Compliance Pressure

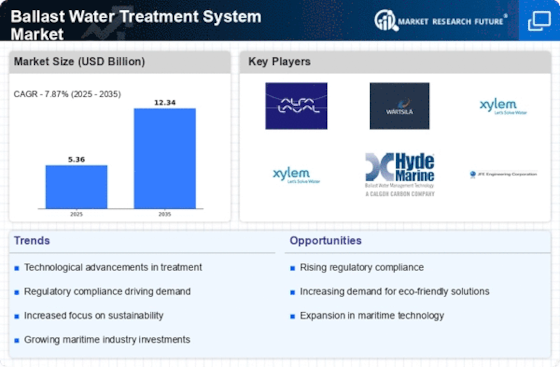

The Ballast Water Treatment System Market is experiencing heightened pressure due to stringent regulatory frameworks established by international maritime organizations. The International Maritime Organization (IMO) has implemented the Ballast Water Management Convention, which mandates the treatment of ballast water to prevent the spread of invasive species. As a result, ship operators are compelled to invest in advanced treatment systems to comply with these regulations. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This regulatory compliance not only drives demand for innovative treatment technologies but also encourages manufacturers to enhance their product offerings to meet evolving standards.

Investment in Maritime Infrastructure

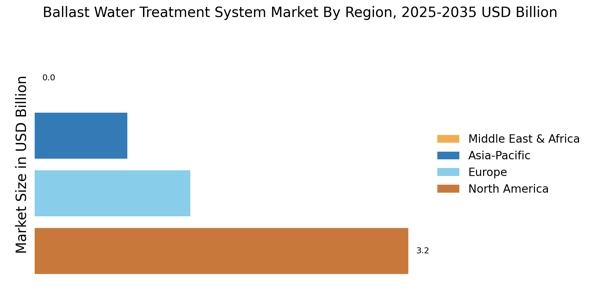

Investment in maritime infrastructure is a crucial driver for the Ballast Water Treatment System Market. Governments and private entities are increasingly allocating funds to enhance port facilities and shipping operations, which includes the implementation of ballast water treatment systems. This investment is essential for ensuring compliance with international regulations and promoting sustainable maritime practices. As ports upgrade their facilities to accommodate modern vessels, the demand for effective ballast water management solutions is expected to rise. Market analysts suggest that this trend will lead to a robust growth trajectory for the ballast water treatment systems, as stakeholders prioritize infrastructure improvements to support the evolving needs of the shipping industry.

Environmental Awareness and Sustainability

The increasing awareness of environmental issues is significantly influencing the Ballast Water Treatment System Market. Stakeholders, including shipping companies and regulatory bodies, are recognizing the importance of sustainable practices in maritime operations. The treatment of ballast water is essential to prevent ecological damage caused by invasive species, which can disrupt local ecosystems. As a result, there is a growing demand for eco-friendly treatment solutions that align with sustainability goals. Market data indicates that the adoption of green technologies in ballast water management is expected to rise, with a notable increase in investments directed towards sustainable practices. This trend is likely to propel the market forward as companies strive to enhance their environmental credentials.