Health and Wellness Trends

Health and wellness trends are increasingly influencing the bakery processing equipment Market. As consumers become more health-conscious, there is a rising demand for healthier baked goods, including gluten-free, low-sugar, and organic options. This shift compels bakeries to invest in processing equipment that can handle alternative ingredients and production techniques. Market data suggests that the demand for healthier bakery products is projected to grow at a rate of 4% per year. Consequently, equipment manufacturers are likely to innovate their offerings to support the production of these health-oriented products, thereby aligning with consumer preferences.

E-commerce Growth in Bakery Sales

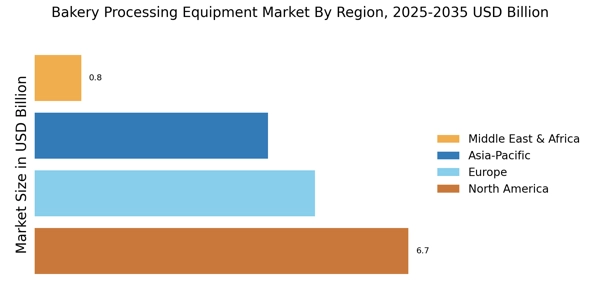

The Bakery Processing Equipment Market is significantly impacted by the growth of e-commerce in bakery sales. As online shopping becomes more prevalent, bakeries are increasingly turning to digital platforms to reach consumers. This trend necessitates the need for efficient processing equipment that can support higher production volumes and ensure product freshness during delivery. Recent statistics indicate that online bakery sales are expected to grow by 7% annually, highlighting the importance of adapting to this new sales channel. Equipment manufacturers are likely to respond by developing solutions that enhance the efficiency and scalability of bakery operations, catering to the demands of the e-commerce market.

Rising Demand for Convenience Foods

The Bakery Processing Equipment Market is experiencing a notable surge in demand for convenience foods. As consumers increasingly seek ready-to-eat and easy-to-prepare options, bakeries are adapting their product lines to meet these preferences. This shift necessitates advanced processing equipment that can efficiently produce a variety of baked goods, from pre-packaged bread to frozen pastries. According to industry reports, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Consequently, manufacturers of bakery processing equipment are likely to innovate and enhance their offerings to cater to this evolving market landscape.

Technological Advancements in Equipment

Technological advancements play a pivotal role in shaping the Bakery Processing Equipment Market. Innovations such as automated mixing, baking, and packaging systems are becoming increasingly prevalent. These advancements not only improve efficiency but also enhance product consistency and quality. For instance, the integration of IoT technology allows for real-time monitoring and control of baking processes, which can lead to reduced waste and energy consumption. The market for smart bakery equipment is expected to witness substantial growth, with estimates suggesting a potential increase of 6% annually. This trend indicates a strong inclination towards adopting cutting-edge technologies in the bakery sector.

Expansion of Artisan and Specialty Bakeries

The Bakery Processing Equipment Market is witnessing a significant expansion of artisan and specialty bakeries. This trend is driven by a growing consumer preference for unique, high-quality baked goods that emphasize craftsmanship and local ingredients. As these bakeries proliferate, there is an increasing demand for specialized processing equipment that can accommodate diverse recipes and production methods. Market analysis indicates that the artisan bakery segment is expected to grow by approximately 5% annually, reflecting a shift in consumer behavior towards premium products. This growth presents opportunities for equipment manufacturers to develop tailored solutions that meet the specific needs of artisan bakers.