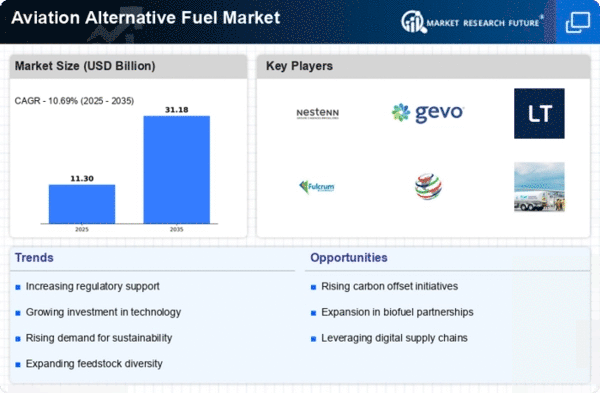

The Aviation Alternative Fuel Market is currently characterized by a dynamic competitive landscape, driven by increasing regulatory pressures and a global push towards sustainability. Key players are actively engaging in innovative strategies to enhance their market positioning. Companies such as Neste (FI), Gevo (US), and LanzaTech (US) are at the forefront, focusing on technological advancements and strategic partnerships to bolster their operational capabilities. Neste (FI) has established itself as a leader in renewable jet fuel production, while Gevo (US) emphasizes the development of sustainable aviation fuel (SAF) through innovative biorefining processes. LanzaTech (US) is leveraging its carbon capture technology to convert waste emissions into valuable fuels, thereby contributing to a circular economy. Collectively, these strategies not only enhance their competitive edge but also shape the overall market dynamics by fostering innovation and sustainability.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for a diverse range of offerings, catering to various customer needs while also driving technological advancements across the sector.

In November Neste (FI) announced a strategic partnership with a leading airline to supply SAF for its operations, marking a significant step towards increasing the availability of sustainable fuel options in the aviation sector. This collaboration is expected to enhance Neste's market presence and solidify its reputation as a key player in the SAF landscape. The partnership not only aligns with global sustainability goals but also positions Neste to capitalize on the growing demand for eco-friendly aviation solutions.

In October Gevo (US) unveiled plans to expand its production capacity for SAF, aiming to meet the rising demand from airlines seeking to reduce their carbon footprints. This expansion is indicative of Gevo's commitment to scaling its operations and enhancing its technological capabilities. By increasing production, Gevo is likely to strengthen its market position and contribute to the broader adoption of sustainable fuels in aviation.

In September LanzaTech (US) secured a significant investment to further develop its carbon capture technology, which is pivotal for producing SAF from waste emissions. This funding is expected to accelerate the commercialization of their innovative processes, thereby enhancing their competitive stance in the market. The ability to convert waste into fuel not only addresses environmental concerns but also positions LanzaTech as a leader in sustainable fuel technology.

As of December the competitive trends in the Aviation Alternative Fuel Market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming more prevalent, as companies recognize the importance of collaboration in achieving sustainability goals. The competitive landscape is shifting from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This evolution suggests that future differentiation will hinge on the ability to deliver sustainable solutions that meet regulatory requirements and consumer expectations.