Regulatory Support

Regulatory frameworks promoting the use of renewable resources are expected to significantly influence the Tall Oil Fatty Acid Market (TOFA) Market. Governments worldwide are implementing policies that encourage the adoption of bio-based chemicals, which may include incentives for manufacturers to produce TOFA. These regulations could lead to increased investments in the TOFA sector, as companies align their operations with environmental standards. In 2025, it is anticipated that the market will benefit from favorable policies aimed at reducing reliance on petroleum-based products. This regulatory support may not only enhance market growth but also foster innovation in TOFA applications, as businesses seek to capitalize on emerging opportunities.

Technological Innovations

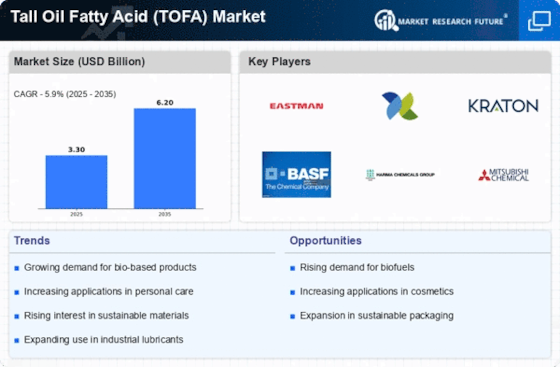

Technological advancements in the production and processing of Tall Oil Fatty Acid Market (TOFA) are likely to play a crucial role in shaping the market landscape. Innovations in extraction techniques and refining processes may enhance yield and reduce production costs, making TOFA more competitive against synthetic alternatives. For instance, the development of enzymatic processes for fatty acid extraction could lead to higher purity levels and better product quality. As of 2025, the TOFA market is expected to witness a compound annual growth rate of around 5%, driven by these technological improvements. Additionally, the integration of automation and digital technologies in manufacturing processes could streamline operations, further propelling the growth of the TOFA Market.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Tall Oil Fatty Acid Market (TOFA) Market. As industries strive to reduce their carbon footprints, the demand for bio-based products, including TOFA, is likely to rise. This shift is evident in the growing preference for renewable resources over fossil fuels. In 2025, the market for bio-based chemicals, which includes TOFA, is projected to reach approximately 20 billion USD, indicating a robust growth trajectory. Companies are increasingly adopting sustainable practices, which may lead to enhanced product offerings and innovations in the TOFA sector. Furthermore, regulatory frameworks promoting eco-friendly materials could further bolster the market, as manufacturers seek to comply with stringent environmental standards.

Diverse Industrial Applications

The versatility of Tall Oil Fatty Acid Market (TOFA) across various industries is a significant driver for its market growth. TOFA is utilized in the production of surfactants, lubricants, and coatings, among other applications. The increasing demand for eco-friendly surfactants in personal care and household products is likely to boost the TOFA Market. In 2025, the demand for TOFA in the personal care sector is projected to grow by approximately 6%, reflecting a broader trend towards natural ingredients. Furthermore, the automotive and construction industries are also exploring TOFA-based products for their performance and environmental benefits. This diverse applicability suggests a robust and expanding market for TOFA, as industries seek sustainable alternatives.

Growing Demand in Emerging Economies

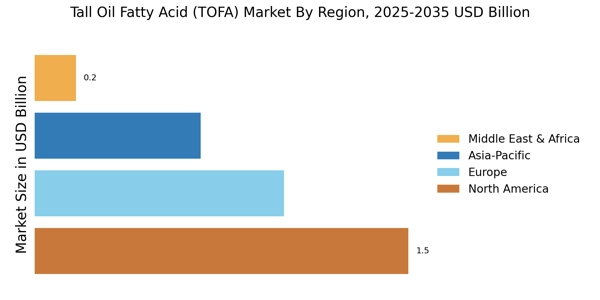

The rising demand for Tall Oil Fatty Acid Market (TOFA) in emerging economies is likely to serve as a catalyst for market expansion. As these regions experience economic growth, there is an increasing need for industrial chemicals, including TOFA, in various applications such as adhesives, paints, and coatings. The TOFA Market is expected to see a surge in demand from countries in Asia and Latin America, where industrialization is accelerating. By 2025, the market in these regions could grow by approximately 7%, driven by the expanding manufacturing sector. This trend suggests that emerging economies may play a pivotal role in shaping the future landscape of the TOFA market, as they seek sustainable and efficient chemical solutions.