Top Industry Leaders in the Aviation Alternative Fuel Market

The aviation industry, a significant contributor to global carbon emissions, is facing increasing pressure to adopt sustainable practices. As a result, the aviation alternative fuel (SAF) market is experiencing explosive growth. This burgeoning market attracts diverse players, each implementing unique strategies to capture market share and navigate the challenges of this nascent domain.

Strategies for Success:

- Technology Leadership: Companies are focusing on R&D to develop cost-effective, scalable, and high-performance SAF technologies. From bio-based fuels like HEFA-SPK to synthetic pathways like power-to-liquid, continuous innovation drives market differentiation.

- Feedstock Diversification: Expanding feedstock sources, such as waste oils or dedicated energy crops, ensures supply chain resilience and reduces reliance on traditional resources.

- Collaboration and Partnerships: Strategic partnerships between airlines, fuel producers, technology providers, and governments are crucial for accelerating SAF adoption and infrastructure development. Examples include initiatives like the Sustainable Aviation Fuel Grand Challenge and the Joint Air Traffic Management Research and Development (JARTM) program.

- Policy Advocacy: Industry players actively engage with policymakers to advocate for supportive policies, such as tax breaks, blending mandates, and carbon pricing mechanisms. These measures incentivize SAF production and uptake.

- Cost Reduction: Addressing the higher cost of SAF compared to conventional jet fuel is essential for wider adoption. Companies are optimizing production processes, exploring feedstock alternatives, and seeking economies of scale to bring down costs.

Factors Influencing Market Share:

- Production Capacity: Leading players with established production facilities and expanding capacity hold a significant advantage. Companies like Neste, World Energy, and Boeing are actively scaling up their operations.

- Technology Maturity: Companies offering proven and certified SAF technologies are better positioned to secure contracts and partnerships. Continuous improvement and cost reduction further enhance their market share.

- Geographical Reach: A global presence facilitates access to feedstock, production facilities, and diverse customer bases. Companies like Gevo and Velocys are expanding their geographical footprint to capture wider market share.

- Sustainability Credentials: Transparency and robust sustainability practices throughout the production process attract environmentally conscious airlines and investors. Companies like Neste and SkyNRG demonstrate leadership in this area.

- Pricing Strategies: Competitive pricing models and flexible contracting options are crucial for attracting airlines, especially cost-sensitive budget carriers.

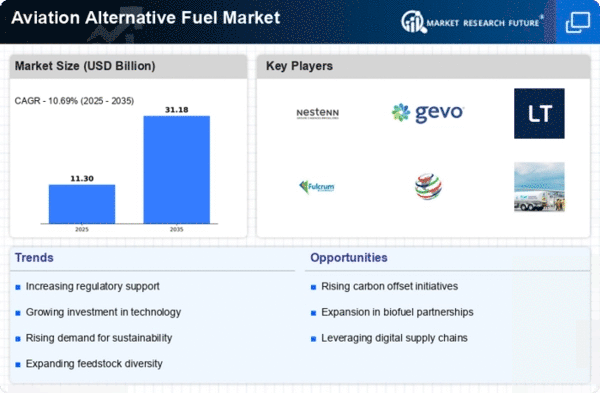

List of Key Players in the Aviation Alternative Fuel Market

- Eni (Italy),

- World Energy (US),

- Gevo (US),

- Neste (Finland)

- SkyNRG (Netherlands),

- Fulcrum Bioenergy (US),

- Velocys (UK), and

- Aemetis, Inc.

- Red Rock Biofuels (US),

- SG Preston Company (US),

- Petrixo Oil & Gas (UAE),

- Sun drop Fuels, Inc. (US),

- Hypoint, Inc. (US), and

- Zero via, Inc. (US).

Recent Developments:

September 2023: LanzaTech partners with Airbus to develop a demonstration plant for SAF production using captured carbon dioxide, showcasing the potential for carbon-negative aviation fuels.

October 2023: The first commercial flight powered by 100% SAF takes off from Amsterdam Schiphol Airport, operated by KLM Royal Dutch Airlines.

November 2023: The US Department of Energy announces $100 million in funding for SAF research and development projects, focusing on advancing new production technologies and feedstocks.

December 2023: A consortium of airlines, fuel producers, and technology providers launches the "SAF Alliance," a global initiative to accelerate the deployment of SAF and achieve net-zero emissions in aviation by 2050.