Market Share

Aviation Alternative Fuel Market Share Analysis

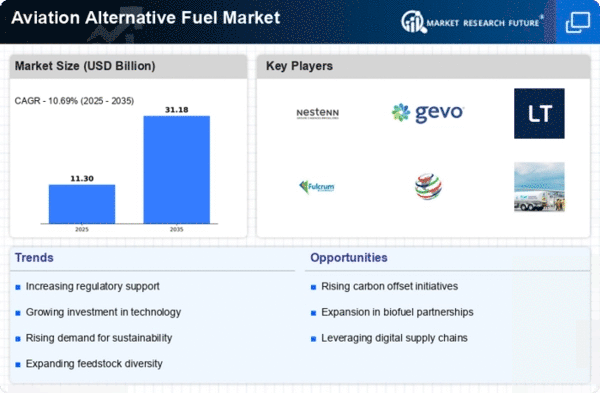

The Aviation Alternative Fuel Market, situated at the intersection of the aviation and renewable energy sectors, employs a variety of strategic approaches to establish a strong market share. Companies operating in this sector navigate the challenges of environmental sustainability and aviation's energy needs by deploying dynamic tactics to differentiate themselves and capture a significant portion of the market.

One foundational strategy in the Aviation Alternative Fuel Market is centered around product differentiation. With an increasing emphasis on reducing carbon emissions, companies focus on developing alternative aviation fuels that not only meet stringent industry standards but also offer unique benefits such as lower greenhouse gas emissions, improved engine performance, and reduced dependence on traditional fossil fuels. By creating innovative fuel formulations, such as biofuels or synthetic fuels, companies aim to appeal to environmentally conscious airlines and regulatory bodies, differentiating themselves in a competitive landscape. This strategy not only attracts airlines seeking to enhance their sustainability credentials but also fosters brand loyalty among those looking for viable alternatives to conventional aviation fuels.

Cost competitiveness is another crucial strategy in the Aviation Alternative Fuel Market. As the aviation industry is cost-sensitive, companies strive to become competitive producers of alternative aviation fuels. Achieving economies of scale through efficient production processes and sourcing cost-effective feedstocks or raw materials enables companies to offer competitive prices. This cost-effective approach is particularly effective in attracting airlines seeking economically viable alternatives that align with their environmental goals. By providing economically feasible alternatives to traditional aviation fuels, companies can secure a significant market share, especially as airlines increasingly prioritize sustainability.

Market segmentation is an effective strategy that involves tailoring alternative aviation fuels to specific airline requirements and regional regulations. By addressing the diverse needs of different airlines, such as long-haul versus short-haul carriers, or those operating in regions with distinct environmental policies, companies can optimize their marketing efforts. This strategy allows for a more targeted approach, positioning companies as specialists in providing alternative fuels suitable for specific aviation applications. Consequently, companies can attract a loyal customer base within each segment, enhancing their overall market share.

Collaborative partnerships and strategic alliances are prevalent strategies in the Aviation Alternative Fuel Market. Companies often form partnerships with airlines, aircraft manufacturers, research institutions, and regulatory bodies to strengthen their position in the industry. Collaborations can lead to shared resources, enhanced research capabilities, and expanded market reach. Joint ventures and mergers and acquisitions are common strategies for consolidating market share, allowing companies to leverage their strengths and offer a comprehensive range of alternative aviation fuel solutions.

Technological innovation is a driving force in market share positioning within the aviation alternative fuel sector. Companies that invest in research and development to create advanced fuel formulations and production processes gain a competitive advantage. Being at the forefront of technological advancements not only attracts airlines seeking sustainable and efficient alternatives but also ensures compliance with evolving environmental regulations and industry standards. Staying ahead in innovation helps companies secure a significant market share by offering alternative fuels that align with the aviation industry's commitment to reducing its carbon footprint.

Geographical expansion is an essential strategy for companies aiming to strengthen their market position in the Aviation Alternative Fuel Market. By entering new markets or expanding their presence in existing ones, companies can tap into diverse customer bases and adapt their alternative fuels to regional aviation needs. This strategy involves understanding the unique regulatory environments, airline preferences, and sustainability goals of different regions and tailoring alternative fuel solutions accordingly. Localized marketing and distribution strategies contribute to successful market penetration, allowing companies to establish themselves as key players in various geographical areas and enhance their overall market share.

Leave a Comment