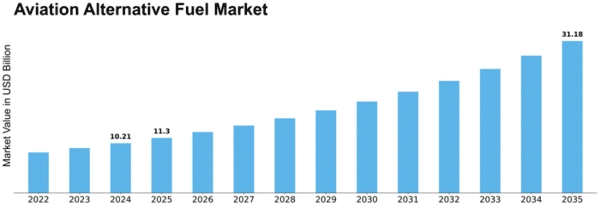

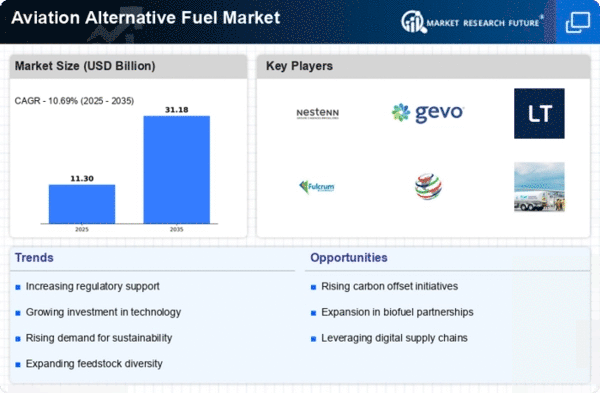

Aviation Alternative Fuel Size

Aviation Alternative Fuel Market Growth Projections and Opportunities

The Aviation Alternative Fuel market is significantly influenced by various factors that collectively shape its growth and trajectory. One primary driver is the increasing awareness and emphasis on sustainability within the aviation industry. With rising concerns about carbon emissions and environmental impact, there is a growing demand for alternative fuels that can reduce the carbon footprint of aviation operations. The aviation sector's commitment to adopting cleaner and more sustainable fuel options is a pivotal force propelling the expansion of the Aviation Alternative Fuel market.

Technological advancements play a crucial role in shaping the Aviation Alternative Fuel market. Continuous research and development efforts focus on improving the production processes and properties of alternative aviation fuels. Innovations in feedstock selection, refining techniques, and production scalability contribute to the development of more efficient and cost-effective alternative fuels. As technology advances, the aviation industry can increasingly integrate these fuels into existing aircraft without significant modifications, fostering the market's growth.

Market dynamics are significantly influenced by global regulatory frameworks and environmental policies. Governments and international aviation bodies are implementing stringent regulations aimed at reducing greenhouse gas emissions and promoting the use of sustainable aviation fuels. Incentives, mandates, and initiatives supporting the adoption of alternative fuels create a conducive environment for the growth of the Aviation Alternative Fuel market. Companies in this market must navigate these regulatory landscapes and align their strategies with the evolving sustainability goals of the aviation industry.

The aviation industry's commitment to energy security is another key factor shaping the Aviation Alternative Fuel market. Diversifying fuel sources reduces dependence on traditional fossil fuels, enhancing the resilience of the aviation sector to geopolitical uncertainties and fluctuations in oil prices. As a result, the industry is increasingly exploring and adopting alternative fuels derived from renewable sources, such as biofuels, synthetic fuels, and hydrogen, contributing to the market's expansion.

Raw material availability and pricing dynamics significantly impact the Aviation Alternative Fuel market. The feedstocks used to produce alternative aviation fuels, whether they are derived from plants, waste materials, or other sources, can experience fluctuations in supply and cost. Effective supply chain management and the development of resilient sourcing strategies are essential for industry players to ensure stable production and pricing of alternative fuels.

Market competition is a pivotal factor influencing the Aviation Alternative Fuel sector. As the demand for sustainable aviation fuels rises, numerous companies are entering the market to capitalize on this emerging opportunity. Intense competition drives continuous innovation, cost reduction efforts, and the scaling up of production capacities. Strategic collaborations, partnerships, and investments in research and development are common strategies employed by companies to strengthen their market position and contribute to the industry's sustainable development.

Consumer preferences and public perception also play a role in shaping the Aviation Alternative Fuel market. With increasing environmental awareness among consumers, there is a growing preference for airlines and aviation companies that prioritize sustainability and use alternative fuels. Positive public perception and support for eco-friendly aviation practices can influence the decisions of airlines and contribute to the wider adoption of alternative aviation fuels.

Leave a Comment