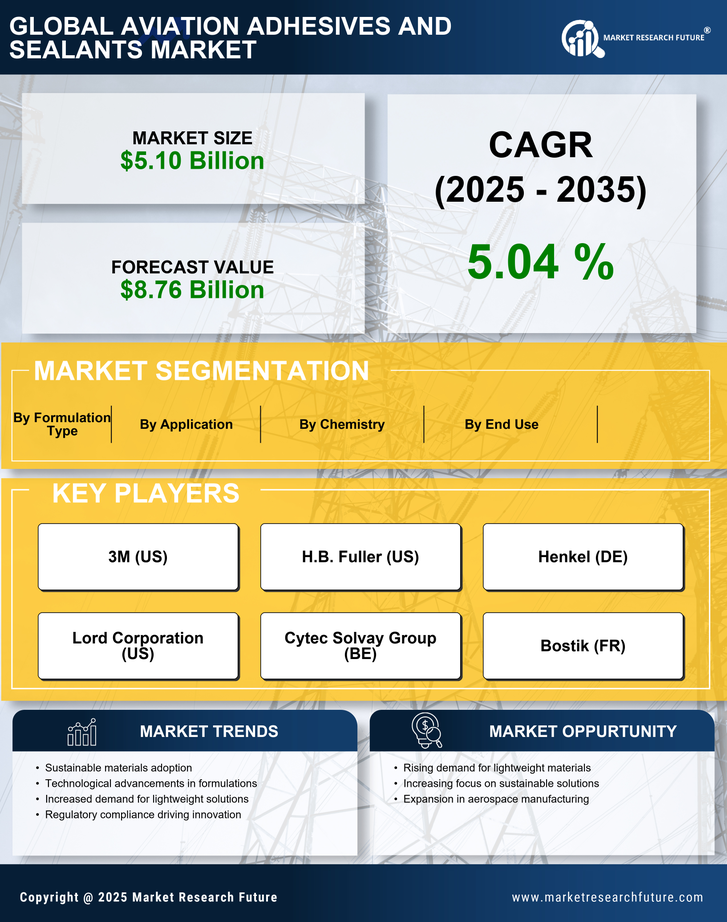

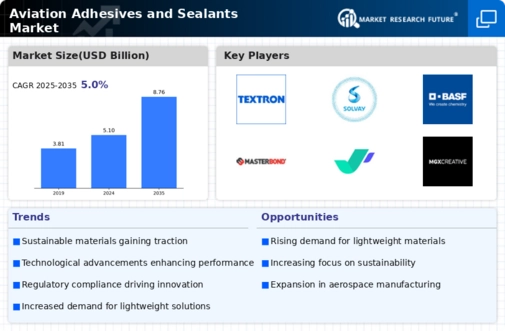

Growth in Aircraft Production

The Aviation Adhesives and Sealants Market is poised for growth due to the rising production rates of commercial and military aircraft. With the global fleet of aircraft projected to increase significantly, manufacturers are ramping up production to meet this demand. According to industry forecasts, the commercial aircraft market alone is expected to deliver over 40,000 new aircraft by 2038. This surge in production necessitates the use of high-performance adhesives and sealants, which are critical for assembly and maintenance processes. As a result, the Aviation Adhesives and Sealants Market is likely to see a corresponding increase in demand, driven by the need for reliable bonding solutions in aircraft manufacturing.

Regulatory Standards and Compliance

The Aviation Adhesives and Sealants Market is influenced by stringent regulatory standards that govern the aerospace sector. Compliance with these regulations is crucial for manufacturers, as non-compliance can lead to significant penalties and safety risks. Regulatory bodies are continuously updating standards to ensure the safety and reliability of aircraft materials, which includes adhesives and sealants. As a result, manufacturers are compelled to invest in high-quality products that meet these evolving standards. This trend is likely to drive growth in the Aviation Adhesives and Sealants Market, as companies seek to ensure compliance while maintaining competitive advantages in a highly regulated environment.

Sustainability and Eco-Friendly Products

The Aviation Adhesives and Sealants Market is increasingly focusing on sustainability and the development of eco-friendly products. As environmental concerns gain prominence, manufacturers are seeking adhesives and sealants that minimize environmental impact while maintaining performance. This shift is reflected in the growing demand for bio-based and low-VOC (volatile organic compound) adhesives, which align with global sustainability initiatives. The market for eco-friendly adhesives is projected to grow significantly, driven by both regulatory pressures and consumer preferences for sustainable solutions. Consequently, the Aviation Adhesives and Sealants Market is likely to evolve, with an emphasis on developing products that meet these sustainability criteria.

Increasing Demand for Lightweight Materials

The Aviation Adhesives and Sealants Market is experiencing a notable shift towards lightweight materials, driven by the aerospace sector's need for fuel efficiency and performance enhancement. As manufacturers seek to reduce aircraft weight, the demand for advanced adhesives and sealants that bond lightweight composites and metals is rising. This trend is underscored by the projected growth of the aerospace industry, which is expected to reach a market value of approximately 1 trillion USD by 2030. Consequently, the Aviation Adhesives and Sealants Market is likely to benefit from this increasing demand, as these materials are essential for ensuring structural integrity while minimizing weight.

Technological Innovations in Adhesive Formulations

The Aviation Adhesives and Sealants Market is benefiting from ongoing technological innovations in adhesive formulations. Advances in chemistry and material science are leading to the development of new adhesives that offer superior performance characteristics, such as enhanced temperature resistance, improved bonding strength, and faster curing times. These innovations are particularly relevant in the aerospace sector, where the performance of adhesives can significantly impact safety and efficiency. As manufacturers increasingly adopt these advanced formulations, the Aviation Adhesives and Sealants Market is likely to experience growth, as these products become essential for meeting the stringent requirements of modern aircraft design and production.