Cost Efficiency

Cost efficiency is a crucial factor driving the Autonomous Last Mile Delivery Robot Market. Businesses are increasingly seeking ways to reduce operational costs while maintaining service quality. Autonomous delivery robots can operate with minimal human intervention, significantly lowering labor costs associated with traditional delivery methods. Furthermore, these robots can work around the clock, enhancing productivity and reducing delivery times. A recent analysis suggests that companies utilizing autonomous delivery solutions could save up to 30% on last-mile delivery costs. This potential for cost reduction is likely to encourage more businesses to adopt autonomous delivery technologies.

E-commerce Growth

The surge in e-commerce activities is significantly propelling the Autonomous Last Mile Delivery Robot Market. As online shopping continues to gain traction, the demand for efficient and timely delivery solutions has escalated. Retailers are increasingly adopting autonomous delivery robots to meet consumer expectations for rapid delivery services. In 2025, e-commerce sales are expected to surpass USD 5 trillion globally, creating a substantial market opportunity for autonomous delivery solutions. This trend suggests that businesses are likely to invest in innovative delivery methods to enhance customer satisfaction and remain competitive in a crowded marketplace.

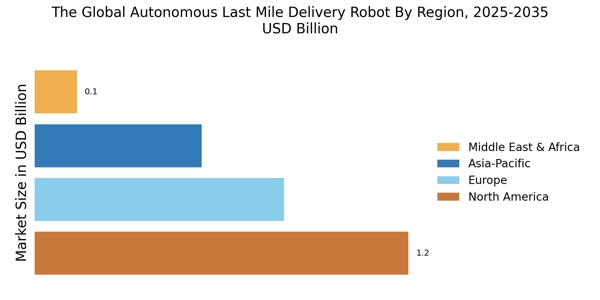

Urbanization Trends

Urbanization trends are reshaping the logistics landscape, thereby influencing the Autonomous Last Mile Delivery Robot Market. As more people migrate to urban areas, the demand for efficient delivery solutions in densely populated regions is on the rise. Delivery robots offer a practical solution to navigate congested streets and deliver goods directly to consumers' doorsteps. It is estimated that by 2030, nearly 60% of the global population will reside in urban areas, further intensifying the need for innovative delivery methods. This demographic shift indicates a growing market for autonomous delivery robots, as they can alleviate traffic congestion and reduce delivery times.

Technological Innovations

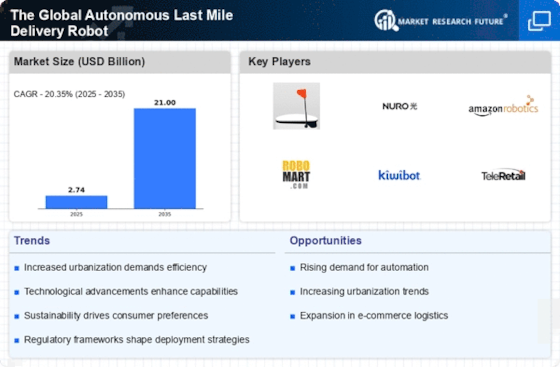

The rapid pace of technological innovations is a primary driver for the Autonomous Last Mile Delivery Robot Market. Advancements in artificial intelligence, machine learning, and robotics are enhancing the capabilities of delivery robots, allowing them to navigate complex urban environments with greater efficiency. For instance, the integration of advanced sensors and computer vision systems enables these robots to detect obstacles and make real-time decisions. According to recent estimates, the market for autonomous delivery robots is projected to reach USD 1.5 billion by 2026, reflecting a compound annual growth rate of approximately 20%. This growth is indicative of the increasing reliance on technology to streamline logistics and improve delivery efficiency.

Consumer Demand for Convenience

Consumer demand for convenience is a pivotal driver of the Autonomous Last Mile Delivery Robot Market. As lifestyles become increasingly fast-paced, consumers are seeking more convenient delivery options that align with their busy schedules. Autonomous delivery robots provide a solution by offering quick and reliable delivery services, often with real-time tracking capabilities. This growing preference for convenience is reflected in consumer surveys, where a significant percentage of respondents express interest in using autonomous delivery services. The market is expected to expand as more consumers embrace these innovative delivery solutions, indicating a shift in consumer behavior towards automation in logistics.