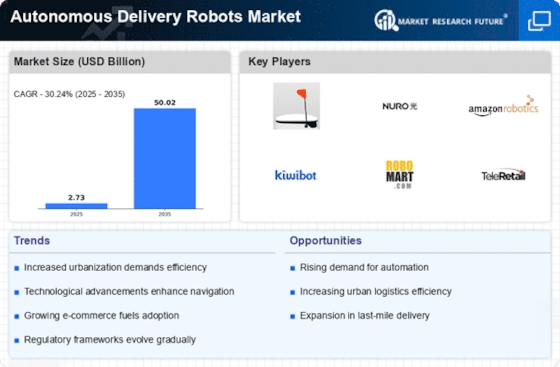

Investment in Logistics Automation

Investment in logistics automation is a key driver of the Autonomous Delivery Robots Market. Companies are increasingly recognizing the potential of automation to enhance operational efficiency and reduce costs. As logistics operations become more complex, the integration of autonomous delivery robots is seen as a strategic move to streamline processes. Recent data indicates that the logistics automation market is expected to reach several billion dollars by the end of the decade, with a significant portion allocated to autonomous delivery solutions. This influx of investment is likely to accelerate the development and deployment of delivery robots, positioning the Autonomous Delivery Robots Market as a critical component of the future logistics ecosystem.

Urbanization and Population Growth

Urbanization and population growth are significant factors driving the Autonomous Delivery Robots Market. As urban areas become more densely populated, the demand for efficient delivery solutions intensifies. The increasing number of consumers in urban settings necessitates innovative approaches to last-mile delivery, where traditional methods may struggle to keep pace. Autonomous delivery robots offer a practical solution to navigate congested city streets and deliver goods directly to consumers' doorsteps. Market projections indicate that urban areas will continue to expand, with a substantial portion of the population residing in cities by 2030. This demographic shift is likely to create a fertile ground for the Autonomous Delivery Robots Market, as businesses seek to adapt to the evolving urban landscape.

Advancements in Robotics Technology

Technological innovations are propelling the Autonomous Delivery Robots Market forward. Recent advancements in robotics, artificial intelligence, and machine learning have enhanced the capabilities of delivery robots, allowing them to navigate complex environments with greater efficiency. These robots are now equipped with sophisticated sensors and algorithms that enable them to avoid obstacles, optimize routes, and ensure timely deliveries. The integration of advanced technologies is expected to increase the operational efficiency of delivery services, potentially reducing delivery times by up to 30%. As these technologies continue to evolve, the Autonomous Delivery Robots Market is likely to witness a surge in adoption across various sectors, including retail, food delivery, and logistics.

Rising Demand for Contactless Delivery

The Autonomous Delivery Robots Market is experiencing a notable increase in demand for contactless delivery solutions. This trend is driven by consumers' growing preference for convenience and safety in their shopping experiences. As e-commerce continues to expand, the need for efficient last-mile delivery options becomes paramount. According to recent estimates, the last-mile delivery segment is projected to grow at a compound annual growth rate of over 15% in the coming years. Autonomous delivery robots offer a viable solution, enabling retailers to meet consumer expectations while reducing operational costs. This shift towards automation in delivery services is likely to reshape the logistics landscape, making the Autonomous Delivery Robots Market a focal point for innovation and investment.

Sustainability and Environmental Concerns

The Autonomous Delivery Robots Market is increasingly influenced by sustainability and environmental considerations. As consumers become more environmentally conscious, there is a growing demand for delivery solutions that minimize carbon footprints. Autonomous delivery robots, which often utilize electric power, present a more sustainable alternative to traditional delivery methods that rely on fuel-powered vehicles. This shift aligns with broader trends towards reducing greenhouse gas emissions and promoting eco-friendly practices. Market data suggests that companies adopting sustainable delivery solutions may see a competitive advantage, as consumers are more likely to support brands that prioritize environmental responsibility. Consequently, the Autonomous Delivery Robots Market is poised to benefit from this heightened focus on sustainability.