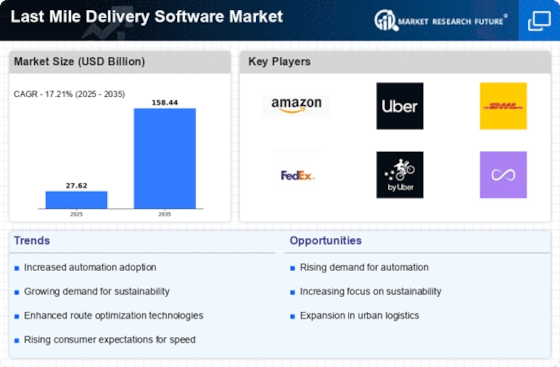

Rising E-commerce Demand

The surge in e-commerce activities has been a pivotal driver for the Last Mile Delivery Software Market. As consumers increasingly prefer online shopping, the demand for efficient last mile delivery solutions has escalated. In 2025, e-commerce sales are projected to reach approximately 6 trillion USD, necessitating robust software solutions to manage logistics effectively. This trend compels businesses to adopt advanced last mile delivery software to enhance customer satisfaction and streamline operations. Companies are investing in technology that offers real-time tracking, route optimization, and automated notifications, which are essential for meeting consumer expectations. The Last Mile Delivery Software Market is thus experiencing significant growth, as businesses seek to improve delivery speed and reliability to remain competitive in a rapidly evolving marketplace.

Technological Advancements

Technological innovations are transforming the Last Mile Delivery Software Market, driving the adoption of sophisticated solutions. The integration of artificial intelligence, machine learning, and data analytics into delivery software enhances operational efficiency and decision-making processes. For instance, AI algorithms can predict delivery times more accurately, while data analytics can identify patterns in consumer behavior, allowing companies to optimize their logistics strategies. As of 2025, the market for AI in logistics is expected to grow substantially, indicating a strong trend towards automation and smart logistics solutions. This technological evolution not only improves service quality but also reduces operational costs, making it a crucial factor in the growth of the Last Mile Delivery Software Market.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a critical driver in the Last Mile Delivery Software Market, as companies increasingly focus on reducing their carbon footprint. The growing awareness of environmental issues has led businesses to seek software solutions that support eco-friendly delivery practices. This includes optimizing delivery routes to minimize fuel consumption and utilizing electric or hybrid vehicles for last mile deliveries. In 2025, it is anticipated that the demand for sustainable logistics solutions will continue to rise, with many companies committing to carbon neutrality. The Last Mile Delivery Software Market is thus adapting to these trends by offering solutions that not only enhance efficiency but also align with corporate sustainability goals, appealing to environmentally conscious consumers.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly shaping the Last Mile Delivery Software Market. Governments worldwide are implementing stricter regulations regarding transportation, safety, and environmental impact, compelling businesses to adopt software solutions that ensure compliance. This includes features that monitor vehicle conditions, track delivery processes, and maintain accurate records for regulatory purposes. As of 2025, the emphasis on compliance is expected to intensify, with companies facing potential penalties for non-adherence. Consequently, the Last Mile Delivery Software Market is witnessing a surge in demand for solutions that not only streamline operations but also facilitate compliance with evolving regulations, thereby enhancing overall operational integrity.

Consumer Expectations for Speed and Convenience

In the contemporary retail landscape, consumer expectations for speed and convenience are at an all-time high, significantly influencing the Last Mile Delivery Software Market. Customers increasingly demand faster delivery options, often expecting same-day or next-day service. This shift in consumer behavior compels retailers and logistics providers to invest in advanced last mile delivery software that can facilitate rapid fulfillment. According to recent studies, nearly 80% of consumers are willing to pay extra for faster delivery, underscoring the importance of efficient logistics solutions. As a result, businesses are prioritizing the implementation of software that can optimize routes, manage delivery schedules, and enhance overall service quality to meet these evolving demands.