Regulatory Compliance

Regulatory compliance is a significant driver in the Automotive Polymer Composites Market, as governments worldwide implement stricter emissions and safety standards. Manufacturers are compelled to develop lighter and more efficient vehicles to meet these regulations, which often necessitates the use of advanced polymer composites. The market is responding to these challenges, with a notable increase in the adoption of composites that not only comply with safety standards but also enhance fuel efficiency. Recent data indicates that vehicles utilizing polymer composites can achieve weight reductions of up to 30%, leading to improved emissions performance. As regulatory frameworks continue to evolve, the demand for compliant materials in the Automotive Polymer Composites Market is expected to rise, prompting further innovation and investment.

Sustainability Initiatives

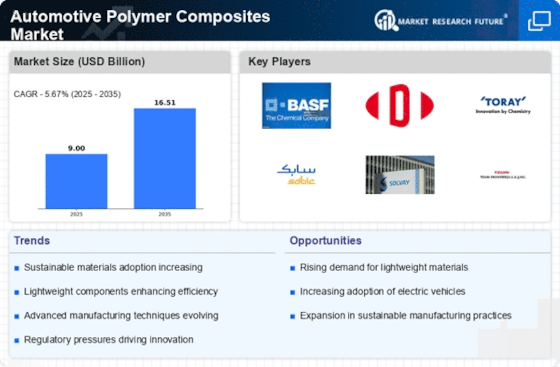

The Automotive Polymer Composites Market is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. Manufacturers are adopting eco-friendly materials and processes to meet stringent regulations and consumer demand for greener vehicles. This shift is evident as the market for bio-based composites is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. Companies are investing in research and development to create composites that not only enhance vehicle performance but also minimize carbon footprints. As a result, the integration of sustainable practices is becoming a key driver in the Automotive Polymer Composites Market, pushing manufacturers to innovate and adapt to changing market dynamics.

Technological Advancements

Technological advancements play a pivotal role in shaping the Automotive Polymer Composites Market. Innovations in manufacturing processes, such as 3D printing and advanced molding techniques, are enabling the production of complex composite structures with enhanced performance characteristics. These advancements are likely to reduce production costs and improve material properties, making polymer composites more attractive for automotive applications. Furthermore, the introduction of lightweight composites is expected to contribute to fuel efficiency and overall vehicle performance. As the automotive sector continues to embrace these technologies, the market for polymer composites is anticipated to expand, with projections indicating a potential increase in market size by over 15% in the next five years.

Integration of Smart Materials

The integration of smart materials into the Automotive Polymer Composites Market is emerging as a transformative trend. Smart materials, which can respond to environmental changes, are being incorporated into automotive designs to enhance functionality and safety. For instance, composites that can change shape or stiffness in response to temperature variations are being explored for use in vehicle components. This innovation not only improves performance but also contributes to the overall efficiency of vehicles. The market for smart materials is expected to grow, with estimates suggesting a potential increase of 20% in adoption rates among automotive manufacturers by 2026. This trend indicates a shift towards more adaptive and responsive automotive designs, further driving the growth of the Automotive Polymer Composites Market.

Consumer Demand for Lightweight Vehicles

Consumer demand for lightweight vehicles is a driving force in the Automotive Polymer Composites Market. As fuel prices fluctuate and environmental awareness grows, consumers are increasingly seeking vehicles that offer better fuel efficiency and lower emissions. Lightweight polymer composites are recognized for their ability to reduce vehicle weight, thereby enhancing fuel economy. Market analysis suggests that the demand for lightweight materials could lead to a market growth rate of approximately 12% over the next few years. This trend is prompting automotive manufacturers to explore and implement polymer composites in various vehicle components, from body panels to interior structures. Consequently, the Automotive Polymer Composites Market is likely to experience robust growth as manufacturers respond to evolving consumer preferences.