Increasing Vehicle Ownership

The rise in vehicle ownership across various regions appears to be a primary driver for the Automotive Motor Oil Market. As more individuals acquire vehicles, the demand for motor oil naturally escalates. Recent statistics indicate that the number of registered vehicles has surged, with estimates suggesting a growth rate of approximately 3% annually. This trend is particularly evident in emerging markets, where urbanization and economic development contribute to higher vehicle sales. Consequently, the Automotive Motor Oil Market is likely to experience a corresponding increase in demand for various types of motor oils, including conventional, synthetic, and blended oils. This growing vehicle population necessitates regular maintenance, further solidifying the market's expansion prospects.

Growth of Aftermarket Services

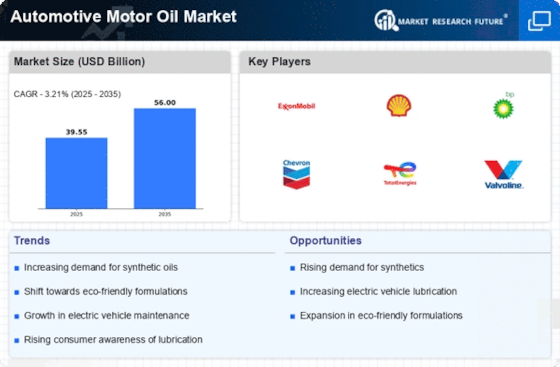

The growth of aftermarket services is a notable driver for the Automotive Motor Oil Market. As vehicle owners increasingly seek maintenance and repair services, the demand for motor oil in the aftermarket segment is likely to rise. Data suggests that the aftermarket for automotive parts and services is projected to grow at a compound annual growth rate of 4% over the next five years. This trend is fueled by the increasing age of vehicles on the road, which necessitates regular oil changes and maintenance. Consequently, the Automotive Motor Oil Market stands to benefit from this expanding aftermarket, as service providers require a steady supply of various motor oils to meet consumer needs.

Consumer Awareness and Education

Consumer awareness and education regarding vehicle maintenance are emerging as significant drivers in the Automotive Motor Oil Market. As individuals become more informed about the importance of using the right motor oil for their vehicles, they are more likely to invest in high-quality products. Educational campaigns by manufacturers and automotive organizations are helping to disseminate information about oil specifications, benefits of synthetic oils, and the impact of oil quality on engine performance. This heightened awareness is likely to lead to increased sales of premium motor oils, as consumers prioritize quality over price. The Automotive Motor Oil Market may thus experience a shift towards higher-value products, reflecting changing consumer preferences.

Technological Advancements in Engine Design

Technological advancements in engine design are reshaping the Automotive Motor Oil Market. Modern engines are engineered for enhanced performance and fuel efficiency, which often requires specialized motor oils. For instance, the introduction of turbocharged engines and direct fuel injection systems has led to a demand for high-performance oils that can withstand increased temperatures and pressures. Market data suggests that the demand for synthetic oils, which offer superior protection and efficiency, is on the rise, with a projected increase of 5% in the next few years. As manufacturers continue to innovate, the Automotive Motor Oil Market must adapt to these changes, ensuring that oil formulations meet the evolving requirements of advanced engine technologies.

Regulatory Standards and Environmental Concerns

Regulatory standards and environmental concerns are increasingly influencing the Automotive Motor Oil Market. Governments worldwide are implementing stricter regulations regarding emissions and fuel efficiency, prompting manufacturers to develop oils that comply with these standards. The introduction of low-viscosity oils, which enhance fuel economy and reduce emissions, is a direct response to these regulations. Market analysis indicates that the demand for environmentally friendly motor oils is expected to grow, with a significant portion of consumers prioritizing sustainability in their purchasing decisions. This shift not only impacts product formulations but also drives innovation within the Automotive Motor Oil Market, as companies strive to meet both regulatory requirements and consumer expectations.