Rising Demand for Energy Efficiency

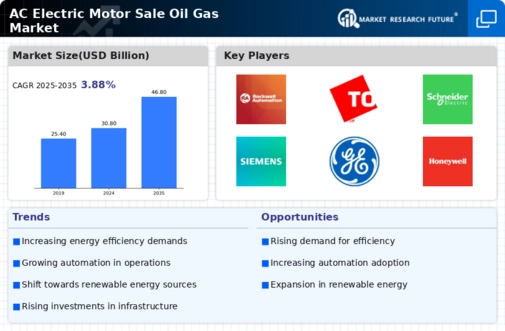

The Global AC Electric Motor Sale Oil Gas Market Industry is experiencing a notable increase in demand for energy-efficient solutions. As industries strive to reduce operational costs and comply with stringent environmental regulations, the adoption of high-efficiency AC electric motors is becoming prevalent. These motors not only enhance performance but also contribute to significant energy savings. For instance, energy-efficient motors can reduce energy consumption by up to 30%, which is particularly relevant in the oil and gas sector where energy costs are substantial. This trend is expected to drive the market's growth, with projections indicating a market value of 30.8 USD Billion in 2024.

Technological Advancements in Motor Design

Innovations in motor design and technology are propelling the Global AC Electric Motor Sale Oil Gas Market Industry forward. The integration of smart technologies, such as IoT and advanced control systems, enhances the operational efficiency and reliability of AC electric motors. These advancements allow for real-time monitoring and predictive maintenance, reducing downtime and operational costs. For example, motors equipped with smart sensors can provide data analytics that optimize performance and energy use. As these technologies become more widespread, they are likely to attract investments and drive market growth, contributing to an anticipated market size of 46.8 USD Billion by 2035.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices are influencing the Global AC Electric Motor Sale Oil Gas Market Industry. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting energy efficiency in industrial operations. These regulations often mandate the use of energy-efficient technologies, including AC electric motors, thereby driving their adoption in the oil and gas sector. For instance, initiatives that encourage the replacement of outdated motors with high-efficiency models are becoming more common. This regulatory support is expected to create a favorable environment for market growth, as companies seek to comply with these standards while enhancing their operational efficiency.

Growing Focus on Renewable Energy Integration

The Global AC Electric Motor Sale Oil Gas Market Industry is witnessing a shift towards integrating renewable energy sources into traditional oil and gas operations. As companies aim to diversify their energy portfolios and reduce reliance on fossil fuels, the demand for AC electric motors that can operate efficiently with renewable energy systems is increasing. This trend is particularly relevant as the industry seeks to enhance sustainability and reduce environmental impacts. The integration of renewable energy technologies, such as solar and wind, requires reliable electric motors for various applications, thereby driving market growth. This shift may lead to a more resilient and adaptable market landscape.

Increasing Investments in Oil and Gas Exploration

The Global AC Electric Motor Sale Oil Gas Market Industry is benefiting from increased investments in oil and gas exploration activities. As global energy demands rise, companies are investing heavily in exploration and production to meet these needs. This surge in exploration activities necessitates the use of reliable and efficient AC electric motors for various applications, including drilling and pumping. The growth in exploration investments is expected to bolster the demand for electric motors, as they are critical components in ensuring operational efficiency. Consequently, this trend is likely to support a compound annual growth rate of 3.88% from 2025 to 2035.