North America : Market Leader in Innovation

North America continues to lead the automotive engineering and design market, holding a significant share of 20.0 in 2024. The region's growth is driven by technological advancements, increasing consumer demand for electric vehicles (EVs), and supportive government regulations promoting sustainability. The push for autonomous driving technologies and enhanced safety features further fuels market expansion, making it a hub for innovation in the automotive sector.

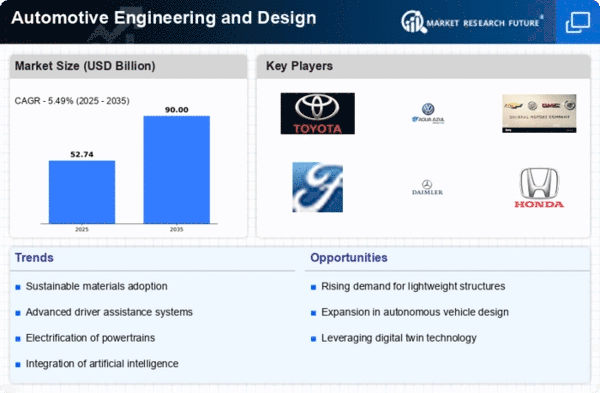

The competitive landscape is characterized by major players such as General Motors Company, Ford Motor Company, and Toyota Motor Corporation, all of which are investing heavily in R&D. The U.S. remains a key player, with states like California leading in EV adoption and infrastructure development. The presence of established automotive giants and a robust supply chain solidifies North America's position as a leader in automotive engineering and design.

Europe : Sustainable Mobility Focus

Europe's automotive engineering and design market, valued at 15.0, is increasingly focused on sustainability and innovation. The region is experiencing a shift towards electric and hybrid vehicles, driven by stringent EU regulations aimed at reducing carbon emissions. This regulatory environment, coupled with consumer demand for greener alternatives, is propelling growth in the automotive sector, making Europe a key player in the global market.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with companies like Volkswagen AG and Daimler AG leading the charge. The competitive landscape is marked by a strong emphasis on R&D, with significant investments in battery technology and autonomous driving. The European market is poised for growth as it adapts to changing consumer preferences and regulatory requirements, ensuring its relevance in the global automotive arena.

Asia-Pacific : Emerging Market Dynamics

The Asia-Pacific region, with a market size of 12.0, is rapidly emerging as a significant player in automotive engineering and design. The growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing middle class, leading to higher demand for vehicles. Additionally, government initiatives promoting electric vehicles and smart transportation solutions are catalyzing market expansion, making this region a focal point for automotive innovation.

Countries like Japan, South Korea, and China are leading the charge, with key players such as Honda Motor Co., Ltd. and Hyundai Motor Company investing heavily in R&D. The competitive landscape is vibrant, with numerous startups and established firms vying for market share. The region's focus on technological advancements, particularly in EVs and autonomous vehicles, positions it as a critical hub for future automotive developments.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa, with a market size of 3.0, presents untapped potential in automotive engineering and design. The region is witnessing a gradual increase in vehicle demand, driven by economic diversification efforts and infrastructure development. Government initiatives aimed at enhancing transportation networks and promoting electric vehicles are expected to catalyze growth in the automotive sector, making it an attractive market for investment.

Countries like South Africa and the UAE are emerging as key players, with local manufacturers and international companies exploring opportunities in the region. The competitive landscape is evolving, with a mix of established automotive brands and new entrants focusing on innovative solutions. As the region continues to develop its automotive capabilities, it is poised for significant growth in the coming years.