Emerging Markets and Globalization

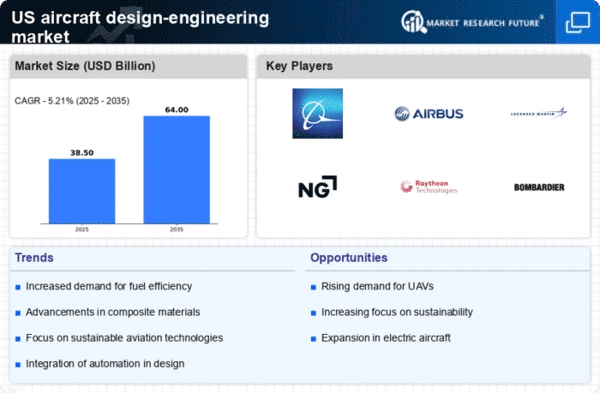

The aircraft design-engineering market is also being shaped by the emergence of new markets and the effects of globalization. As economies in regions such as Asia and South America grow, there is an increasing demand for air travel, which in turn drives the need for new aircraft designs. This expansion presents opportunities for US manufacturers to collaborate with international partners, enhancing their design capabilities and market reach. The potential for joint ventures and partnerships could lead to innovative solutions and shared resources, thereby fostering growth in the aircraft design-engineering market. Analysts suggest that this trend may contribute to a market growth rate of around 5% over the next few years.

Increased Demand for Fuel Efficiency

The aircraft design-engineering market is significantly influenced by the growing demand for fuel efficiency. Airlines are under pressure to reduce operational costs and minimize their carbon footprint, prompting a shift towards more efficient aircraft designs. Innovations such as aerodynamic improvements and advanced propulsion systems are being prioritized to meet these demands. According to industry reports, fuel-efficient aircraft can reduce fuel consumption by as much as 15%, which is a substantial saving for airlines. This trend is expected to drive investments in research and development, with the market projected to expand at a CAGR of 6% as manufacturers respond to these evolving requirements.

Investment in Research and Development

Investment in research and development (R&D) is a pivotal driver for the aircraft design-engineering market. As competition intensifies, companies are allocating substantial resources to R&D to innovate and improve aircraft designs. This investment is crucial for developing next-generation technologies, such as electric propulsion and autonomous systems, which are expected to play a significant role in the future of aviation. The aircraft design-engineering market is likely to benefit from increased funding, with estimates indicating that R&D expenditures could rise by 7% annually. This focus on innovation not only enhances product offerings but also positions companies to better meet the evolving demands of the aviation industry.

Technological Advancements in Materials

The aircraft design-engineering market is experiencing a notable shift due to advancements in materials science. Innovations such as lightweight composites and advanced alloys are enhancing aircraft performance and fuel efficiency. For instance, the use of carbon fiber reinforced polymers can reduce aircraft weight by up to 20%, leading to lower operational costs. This trend is particularly relevant as the industry seeks to meet stringent environmental regulations. Furthermore, the integration of smart materials that can adapt to changing conditions is likely to revolutionize design processes. As manufacturers increasingly adopt these materials, the aircraft design-engineering market is expected to grow, with projections indicating a compound annual growth rate (CAGR) of around 5% over the next five years.

Regulatory Compliance and Safety Standards

Regulatory compliance remains a critical driver in the aircraft design-engineering market. The Federal Aviation Administration (FAA) and other regulatory bodies impose rigorous safety standards that manufacturers must adhere to. These regulations not only ensure passenger safety but also influence design processes and engineering practices. Compliance with these standards often necessitates significant investment in research and development, which can drive innovation within the market. As the industry evolves, the need for enhanced safety features and systems integration is likely to increase, potentially leading to a market growth rate of approximately 4% annually. This focus on safety and compliance is essential for maintaining public trust and operational integrity.