Integration of Electric Vehicles

The rise of electric vehicles (EVs) is reshaping the automotive acoustic-engineering-services market. Unlike traditional internal combustion engine vehicles, EVs operate more quietly, which presents unique challenges in sound design and noise management. As the EV market is expected to grow to 30% of total vehicle sales by 2030, the need for specialized acoustic engineering services becomes increasingly critical. Manufacturers are now focusing on creating sound profiles that enhance the driving experience while ensuring compliance with noise regulations. This shift towards electric mobility is likely to drive significant growth in the automotive acoustic-engineering-services market.

Growth of the Automotive Industry

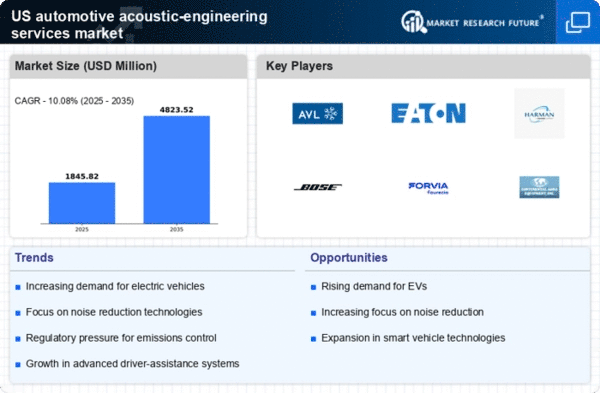

The overall growth of the automotive sector is a pivotal driver for the automotive acoustic-engineering-services market. As vehicle production increases, so does the demand for enhanced acoustic solutions to address noise and vibration issues. The automotive sector in the US is projected to grow at a CAGR of 4% through 2028, leading to a corresponding rise in the need for acoustic engineering services. This growth is fueled by the introduction of new models and technologies, which require sophisticated acoustic solutions to meet consumer expectations and regulatory standards. Consequently, the automotive acoustic-engineering-services market is poised for substantial expansion.

Regulatory Compliance and Standards

The automotive acoustic-engineering-services market is significantly influenced by regulatory compliance and evolving standards. Government regulations aimed at reducing vehicular noise pollution are becoming more stringent, necessitating that manufacturers adopt advanced acoustic engineering solutions. For instance, the Environmental Protection Agency (EPA) has set forth guidelines that require vehicles to meet specific noise level thresholds. As a result, companies are compelled to invest in acoustic engineering services to ensure compliance, which is projected to increase market demand by approximately 15% over the next five years. This regulatory landscape is a crucial driver for the automotive acoustic-engineering-services market.

Consumer Preferences for Enhanced Comfort

In the automotive acoustic-engineering-services market, consumer preferences are shifting towards vehicles that offer superior comfort and reduced noise levels. Surveys indicate that nearly 70% of consumers prioritize quiet cabin environments when purchasing vehicles. This trend compels manufacturers to invest in acoustic engineering services to meet these expectations. As a result, the demand for specialized acoustic solutions is expected to rise, with the market projected to reach $1.5 billion by 2026. This consumer-driven focus on comfort is a significant driver for the automotive acoustic-engineering-services market, pushing companies to innovate and enhance their offerings.

Technological Advancements in Acoustic Materials

The automotive acoustic-engineering-services market is experiencing a surge in demand due to rapid advancements in acoustic materials. Innovations such as lightweight composites and sound-absorbing foams are being integrated into vehicle designs, enhancing noise reduction capabilities. These materials not only improve passenger comfort but also contribute to overall vehicle performance. The market for these advanced materials is projected to grow at a CAGR of approximately 8% through 2027, indicating a robust trend towards improved acoustic solutions. As manufacturers seek to differentiate their products, the adoption of cutting-edge acoustic materials becomes essential, driving the automotive acoustic-engineering-services market forward.