Electric Vehicle Proliferation

The Global Automotive Acoustic Engineering Services Market is experiencing a paradigm shift with the proliferation of electric vehicles (EVs). Unlike traditional internal combustion engine vehicles, EVs operate more quietly, which presents unique challenges and opportunities for acoustic engineering. As the market for EVs expands, manufacturers are focusing on sound design to enhance the driving experience and ensure safety. This includes the development of artificial sounds to alert pedestrians and improve overall vehicle acoustics. The EV market is projected to grow exponentially, with estimates suggesting that electric vehicles could account for a significant portion of total vehicle sales in the coming years. This shift is likely to drive demand for specialized acoustic engineering services tailored to the unique characteristics of electric vehicles.

Integration of Smart Technologies

The Automotive Acoustic Engineering Services Industry is increasingly shaped by the integration of smart technologies in vehicles. Advanced driver-assistance systems (ADAS) and infotainment systems require careful acoustic design to ensure optimal performance and user experience. As vehicles become more connected and automated, the need for precise acoustic engineering becomes paramount to minimize noise interference and enhance sound quality. This trend is expected to drive significant growth in the market, as manufacturers seek to incorporate these technologies seamlessly into their designs. The rise of smart vehicles is likely to create new avenues for acoustic engineering services, emphasizing the importance of sound quality in the overall driving experience.

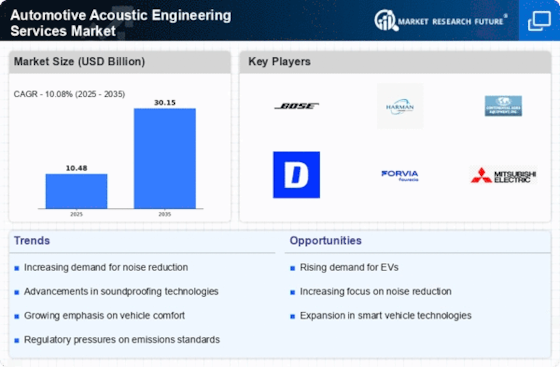

Regulatory Compliance and Standards

The Automotive Acoustic Engineering Services Sector is increasingly influenced by stringent regulatory frameworks aimed at reducing noise pollution and enhancing vehicle safety. Governments worldwide are implementing regulations that mandate specific noise levels for vehicles, which necessitates the adoption of advanced acoustic engineering solutions. This compliance not only ensures that manufacturers meet legal requirements but also enhances the overall quality of vehicles. As a result, the demand for specialized acoustic engineering services is expected to rise, with the market projected to grow at a compound annual growth rate of approximately 5% over the next few years. This trend indicates a robust opportunity for service providers to innovate and develop solutions that align with evolving regulations.

Consumer Demand for Enhanced Comfort

The Automotive Acoustic Engineering Services Sector is significantly driven by rising consumer expectations for comfort and luxury in vehicles. As consumers become more discerning, the demand for quieter cabins and superior acoustic performance is intensifying. This trend is particularly evident in the premium vehicle segment, where manufacturers are investing heavily in acoustic engineering to differentiate their products. Research indicates that vehicles with optimized acoustic properties can command higher prices and customer satisfaction ratings. Consequently, automotive companies are increasingly seeking specialized acoustic engineering services to meet these consumer demands, thereby propelling market growth and creating opportunities for service providers.

Technological Advancements in Materials

The Automotive Acoustic Engineering Services Industry is witnessing a significant shift due to advancements in materials science. The development of lightweight, sound-absorbing materials is transforming vehicle design and manufacturing processes. These innovations allow for improved sound insulation and noise reduction, which are critical for enhancing passenger comfort. As manufacturers increasingly prioritize acoustic performance, the demand for specialized engineering services that can integrate these new materials into vehicle designs is likely to surge. The market for acoustic materials is projected to reach several billion dollars, indicating a substantial opportunity for acoustic engineering firms to capitalize on these advancements and offer tailored solutions to automotive manufacturers.