Increasing Vehicle Production

The automotive industry continues to experience a rise in vehicle production, which directly influences the Automotive Engine Oil Market. As manufacturers ramp up production to meet consumer demand, the need for high-quality engine oils becomes paramount. In 2025, the production of passenger cars is projected to reach approximately 70 million units, indicating a robust market for engine oils. This surge in vehicle production not only drives the demand for engine oil but also encourages innovation in oil formulations to enhance performance and efficiency. Consequently, the Automotive Engine Oil Market is likely to benefit from this upward trend, as more vehicles on the road necessitate regular oil changes and maintenance, thereby sustaining market growth.

Growth of the Aftermarket Segment

The aftermarket segment of the automotive industry is experiencing substantial growth, which is beneficial for the Automotive Engine Oil Market. As vehicles age, the need for maintenance and replacement parts increases, leading to a higher demand for engine oils in the aftermarket. In 2025, the aftermarket for automotive parts and services is projected to reach a valuation of over 400 billion, indicating a lucrative opportunity for engine oil manufacturers. This growth is driven by factors such as an increasing number of older vehicles on the road and a rising trend of DIY maintenance among consumers. Consequently, the Automotive Engine Oil Market stands to gain from this expanding aftermarket, as consumers seek reliable and high-performance oils to ensure their vehicles operate efficiently.

Environmental Regulations and Standards

The implementation of stringent environmental regulations is shaping the Automotive Engine Oil Market. Governments worldwide are enforcing standards aimed at reducing emissions and promoting sustainability, which in turn influences the formulation of engine oils. Manufacturers are increasingly required to produce oils that meet these regulations, leading to the development of eco-friendly and biodegradable products. The demand for low-SAPS (sulfated ash, phosphorus, and sulfur) oils is on the rise, as they contribute to lower emissions and improved fuel economy. As these regulations become more prevalent, the Automotive Engine Oil Market is likely to see a shift towards greener products, creating both challenges and opportunities for manufacturers to innovate and comply with new standards.

Rising Awareness of Vehicle Maintenance

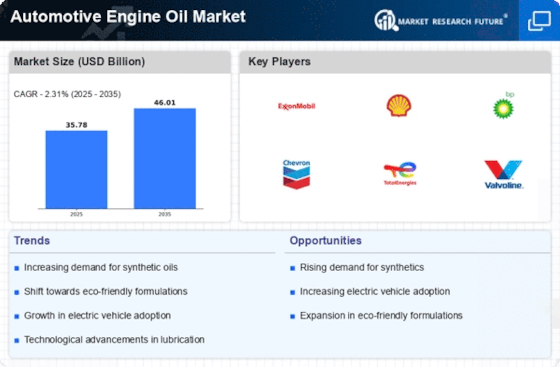

There is a growing awareness among consumers regarding the importance of regular vehicle maintenance, which positively influences the Automotive Engine Oil Market. As vehicle owners become more informed about the benefits of using high-quality engine oils, they are more likely to invest in premium products that enhance engine performance and longevity. This trend is reflected in the increasing sales of synthetic and semi-synthetic oils, which are perceived as superior alternatives to conventional oils. In 2025, the market for synthetic engine oils is expected to account for over 50% of total engine oil sales, underscoring the shift towards quality products. This heightened awareness not only drives sales but also encourages manufacturers to innovate and improve their offerings in the Automotive Engine Oil Market.

Technological Advancements in Engine Design

The ongoing advancements in engine technology significantly impact the Automotive Engine Oil Market. Modern engines are designed to operate at higher temperatures and pressures, necessitating the development of specialized engine oils that can withstand these conditions. For instance, the introduction of turbocharged engines and direct fuel injection systems has led to a demand for low-viscosity oils that provide better fuel efficiency and engine protection. As manufacturers innovate and enhance engine designs, the Automotive Engine Oil Market must adapt by offering products that meet these evolving requirements. This dynamic interplay between engine technology and oil formulation is likely to drive growth and create opportunities for market players.