Rising Vehicle Production

The increasing production of vehicles is a primary driver for the Automotive Engine Oil Level Sensor Market. As manufacturers ramp up production to meet consumer demand, the need for advanced engine components, including oil level sensors, becomes more pronounced. In 2025, the automotive sector is projected to produce over 90 million vehicles, which indicates a robust market for engine oil level sensors. These sensors play a crucial role in ensuring optimal engine performance and longevity, thereby enhancing the overall reliability of vehicles. Consequently, the growth in vehicle production directly correlates with the demand for innovative automotive technologies, including oil level sensors, which are essential for modern engines.

Growth of Aftermarket Services

The growth of aftermarket services is emerging as a significant driver for the Automotive Engine Oil Level Sensor Market. As vehicle owners increasingly seek to maintain and enhance their vehicles' performance, the demand for replacement parts, including oil level sensors, is on the rise. In 2025, the aftermarket segment is expected to account for a substantial share of the overall automotive market, driven by a growing awareness of vehicle maintenance. This trend is further supported by the increasing complexity of modern vehicles, which necessitates the use of high-quality replacement components. Consequently, the expansion of aftermarket services is likely to bolster the demand for automotive oil level sensors.

Stringent Emission Regulations

Stringent emission regulations imposed by various governments worldwide are significantly influencing the Automotive Engine Oil Level Sensor Market. These regulations necessitate the adoption of advanced technologies that minimize emissions and enhance fuel efficiency. Oil level sensors contribute to this by ensuring that engines operate within optimal parameters, thereby reducing harmful emissions. As of 2025, many regions are enforcing stricter standards, compelling manufacturers to integrate sophisticated oil level monitoring systems into their vehicles. This trend not only supports compliance with environmental regulations but also drives innovation in sensor technology, further propelling the market for automotive oil level sensors.

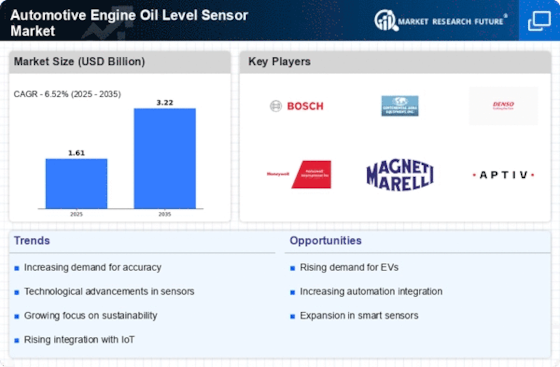

Technological Innovations in Sensor Design

Technological innovations in sensor design are reshaping the Automotive Engine Oil Level Sensor Market. The advent of smart sensors equipped with advanced features such as real-time monitoring and data analytics is enhancing the functionality of oil level sensors. These innovations allow for more accurate readings and improved engine management, which is crucial for modern vehicles. In 2025, the market is witnessing a shift towards more integrated sensor systems that communicate with onboard diagnostics, thereby providing comprehensive insights into engine health. This trend not only boosts the demand for oil level sensors but also encourages manufacturers to invest in research and development to stay competitive.

Integration of Advanced Driver Assistance Systems (ADAS)

The integration of Advanced Driver Assistance Systems (ADAS) is significantly impacting the Automotive Engine Oil Level Sensor Market. As vehicles become more technologically advanced, the incorporation of ADAS features necessitates the use of sophisticated sensors, including oil level sensors, to ensure optimal engine performance. In 2025, the market for ADAS is projected to grow substantially, driven by consumer demand for enhanced safety and convenience features. This integration not only improves vehicle safety but also enhances the overall driving experience, thereby increasing the reliance on advanced sensor technologies. As a result, the demand for automotive oil level sensors is expected to rise in tandem with the proliferation of ADAS in modern vehicles.