Top Industry Leaders in the Automotive Aluminum Market

*Disclaimer: List of key companies in no particular order

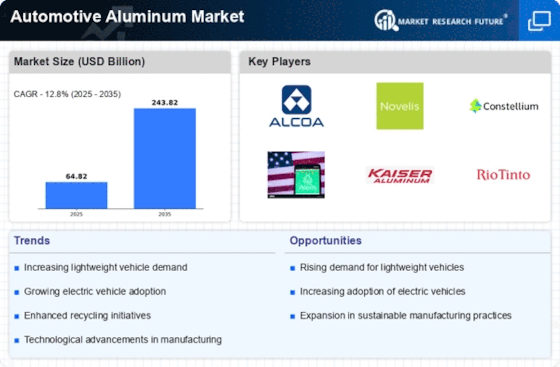

Top listed global companies in the Automotive Aluminum industry are:

Alcoa Corporation

Novelis Inc.

UACJ Corporation

Norsk Hydro ASA

AMG Advanced Metallurgical Group

Constellium

Aluminum Corporation of China Limited

Rio Tinto Group

Aleris Corporation

Autoneum Holding AG

Dana Limited

ElringKlinger AG

Progress-Werk Oberkirch AG

JINDAL ALUMINIUM LTD.

Kaiser Aluminum

Lorin Industries among others

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Aluminum Top Players

The automotive aluminum market is revving up, driven by a relentless pursuit of fuel efficiency and emissions reduction. Aluminum's lightweight prowess, coupled with its recyclability and design flexibility, has propelled it to the forefront of material choices for modern vehicles. This dynamic landscape is teeming with competition, with key players jostling for market share and deploying diverse strategies to secure their place in the fast lane.

Giants in the Gearbox:

Aluminum Titans: Global behemoths like Novelis, Norsk Hydro, and Rio Tinto dominate the scene, boasting extensive production capacities, R&D prowess, and established relationships with major automakers. Their focus lies on developing high-strength alloys, optimizing production processes, and expanding geographical reach. Novelis, for instance, is investing $2.5 billion in a new low-carbon recycling and rolling plant, underscoring their commitment to sustainability.

Regional Powerhouses: Companies like China's Aluminum Corporation of China (Chalco) and Hindalco in India are flexing their muscles in their respective regions. They leverage cost advantages and local market knowledge to capture significant market share. Chalco's strategic partnerships with Chinese automakers like Geely and SAIC Motor are a testament to their regional dominance.

Shifting Gears: Key Strategies for Market Share:

Innovation Engine: The race for lightweight supremacy is fueled by constant innovation. Companies are developing new alloys with improved strength-to-weight ratios, enabling lighter and more fuel-efficient vehicles. Novelis' Advanted Aluminum, for example, offers 20% weight reduction compared to traditional alloys.

Vertical Integration: Integrating upstream bauxite mining and downstream casting and rolling processes creates a cost advantage and control over the supply chain. Norsk Hydro's vertical integration strategy allows them to offer competitive pricing and ensure consistent quality.

Sustainability Soaring: Environmental consciousness is driving demand for recycled aluminum. Companies like Hydro are investing heavily in recycling facilities, while others like Rio Tinto are focusing on reducing the carbon footprint of their production processes.

Emerging Trends: Shifting the Landscape:

Electric Avenue: The rise of electric vehicles (EVs) presents a new opportunity for aluminum. Its lightweight properties are crucial for extending EV range and improving energy efficiency. Companies are developing alloys specifically tailored for EV applications, such as battery enclosures and chassis components.

Additive Manufacturing: 3D printing with aluminum is revolutionizing the design and production of automotive parts. This technology enables complex geometries and lightweight structures, offering design freedom and weight savings. Companies like Alcoa are partnering with 3D printing startups to explore this burgeoning market.

Circular Economy: The concept of a closed-loop system for aluminum is gaining traction. Companies are establishing recycling partnerships and exploring closed-loop manufacturing processes to minimize waste and maximize resource utilization.

Competitive Scenario: A Constant Evolution:

The automotive aluminum market is a dynamic battlefield, with the competitive landscape constantly evolving. New entrants, technological advancements, and shifting consumer preferences are key factors shaping the future. Companies that can adapt their strategies, embrace innovation, and prioritize sustainability are poised to take the checkered flag in this high-stakes race.

Conclusion:

The automotive aluminum market is a vibrant ecosystem where innovation, sustainability, and fierce competition converge. As the demand for lightweight, fuel-efficient vehicles continues to grow, aluminum will remain a key material in the driver's seat. The companies that can navigate this dynamic landscape and adapt their strategies to the evolving trends will be the ones who secure their place on the podium of automotive manufacturing.

Latest Company Updates:

Novelis Inc.:

- Completed the acquisition of Aluminium Stewardship Initiative (ASI) certification for its Plettenberg-Leinscheid plant in Germany. (Source: Novelis press release, Jan 2024)

UACJ Corporation:

- Successfully developed a new high-strength aluminum alloy for aerospace applications. (Source: UACJ press release, Dec 2023)

Norsk Hydro ASA:

- Partnering with Equinor to develop a pilot project for CO2-free aluminum production using renewable energy. (Source: Norsk Hydro press release, Dec 2023)