Consumer Preferences

Shifting consumer preferences towards lightweight and fuel-efficient vehicles are driving the Automotive Aluminum Extrusion Market. Today's consumers are more informed and concerned about environmental impacts, leading to a preference for vehicles that offer better fuel economy. Aluminum extrusions, known for their lightweight properties, contribute significantly to reducing overall vehicle weight, thereby enhancing fuel efficiency. Recent surveys indicate that nearly 70% of consumers prioritize fuel efficiency when purchasing a vehicle, which is likely to influence automakers' material choices. Consequently, the automotive aluminum extrusion market is expected to expand, with projections suggesting a growth rate of around 6% in the coming years. This consumer-driven demand for efficiency and sustainability is prompting manufacturers to increasingly incorporate aluminum extrusions into their vehicle designs.

Sustainability Focus

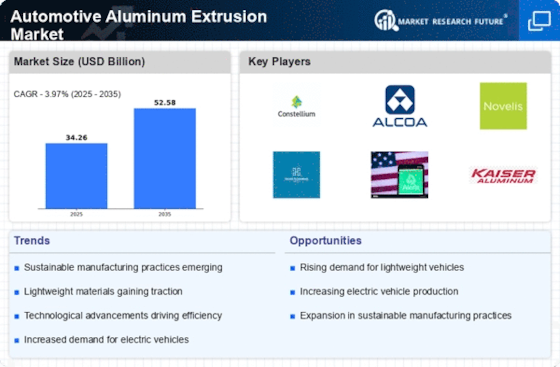

The increasing emphasis on sustainability within the automotive sector appears to be a pivotal driver for the Automotive Aluminum Extrusion Market. As manufacturers strive to reduce their carbon footprints, aluminum's recyclability and lightweight properties make it an attractive option. In fact, aluminum can be recycled indefinitely without losing its properties, which aligns with the industry's shift towards more sustainable practices. This trend is further supported by regulatory frameworks that encourage the use of lighter materials to enhance fuel efficiency. The automotive aluminum extrusion market is projected to witness a compound annual growth rate (CAGR) of approximately 5% over the next few years, driven by this sustainability focus. Consequently, automakers are increasingly incorporating aluminum extrusions in vehicle designs to meet both consumer demand and regulatory requirements.

Regulatory Compliance

Regulatory compliance is becoming an essential driver for the Automotive Aluminum Extrusion Market. Governments worldwide are implementing stringent regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. These regulations often mandate the use of lightweight materials, such as aluminum, to achieve compliance. As a result, automotive manufacturers are increasingly turning to aluminum extrusions to meet these regulatory requirements. The automotive aluminum extrusion market is projected to benefit from this trend, with estimates indicating a potential market growth of 8% over the next five years. This regulatory landscape not only encourages innovation in material usage but also compels manufacturers to adopt aluminum solutions to remain competitive in a rapidly evolving market.

Technological Advancements

Technological advancements in manufacturing processes are significantly influencing the Automotive Aluminum Extrusion Market. Innovations such as advanced extrusion techniques and improved alloy compositions are enhancing the performance and application range of aluminum extrusions. For instance, the development of high-strength aluminum alloys has expanded their use in critical structural components, thereby increasing their market share. Moreover, automation and digitalization in production processes are streamlining operations, reducing costs, and improving product quality. As a result, the automotive aluminum extrusion market is expected to grow, with estimates suggesting a market size increase of around 10% by 2027. These advancements not only improve efficiency but also enable manufacturers to meet the evolving demands of the automotive industry.

Electric Vehicle Integration

The integration of electric vehicles (EVs) into the automotive landscape is emerging as a crucial driver for the Automotive Aluminum Extrusion Market. As the demand for EVs continues to rise, manufacturers are increasingly utilizing aluminum extrusions to enhance vehicle performance and efficiency. Aluminum's lightweight nature contributes to improved battery range and overall vehicle dynamics, making it a preferred material for EV components. Recent data indicates that the EV market is expected to grow at a CAGR of over 20% in the coming years, further propelling the demand for aluminum extrusions. This trend suggests that automakers are likely to invest more in aluminum technologies to optimize their electric vehicle offerings, thereby bolstering the automotive aluminum extrusion market.