Cost Efficiency

Cost efficiency is a driving factor in the Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry, as operators seek to reduce operational expenses while maintaining safety standards. ADS-B systems are known for their lower installation and maintenance costs compared to traditional radar systems. This economic advantage makes ADS-B an attractive option for both commercial and general aviation operators. Furthermore, the ability to reduce fuel consumption through optimized flight paths can lead to substantial cost savings. As airlines and operators increasingly recognize these benefits, the market is likely to witness accelerated growth, aligning with the projected CAGR of 20.61% from 2025 to 2035.

Growing Air Traffic

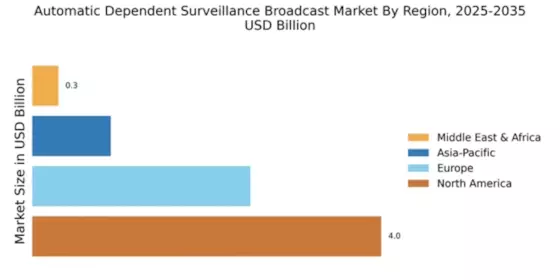

The Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry is experiencing growth driven by the increasing volume of air traffic globally. As more airlines expand their fleets and new routes are established, the demand for effective air traffic management solutions rises. ADS-B technology offers real-time data sharing, which is crucial for managing congested airspace. The International Civil Aviation Organization (ICAO) projects that global air traffic will double by 2035, necessitating the adoption of advanced surveillance systems like ADS-B. This trend is expected to contribute significantly to the market, which is projected to reach 263.8 USD Billion by 2035, underscoring the critical need for enhanced safety and efficiency in aviation.

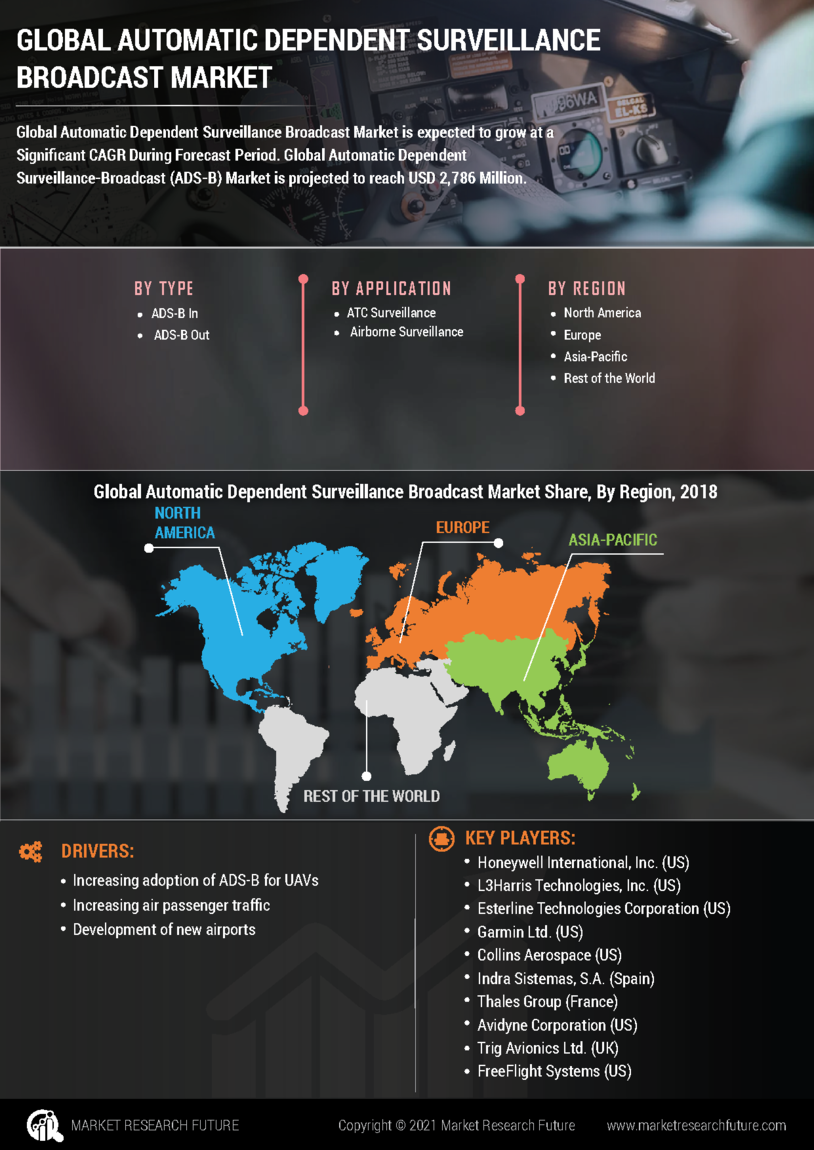

Regulatory Mandates

The Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry is significantly influenced by regulatory mandates imposed by aviation authorities worldwide. For instance, the Federal Aviation Administration (FAA) in the United States has mandated the use of ADS-B for all aircraft operating in controlled airspace. This regulatory push is expected to drive market growth, as compliance becomes essential for operational efficiency and safety. As a result, the market is projected to reach 33.6 USD Billion in 2024, with increasing adoption rates among airlines and private operators. Such regulations not only enhance situational awareness but also improve air traffic management, thereby fostering a safer aviation environment.

Market Growth Projections

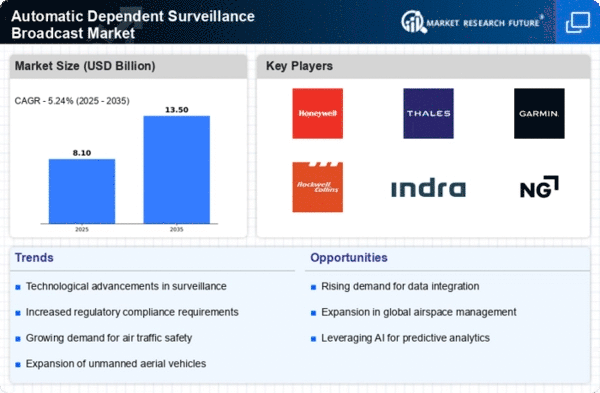

The Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry is poised for substantial growth, with projections indicating a market size of 263.8 USD Billion by 2035. This growth trajectory reflects the increasing adoption of ADS-B technology across various sectors of aviation. The anticipated CAGR of 20.61% from 2025 to 2035 suggests a robust demand for advanced surveillance solutions. The market dynamics are influenced by factors such as regulatory requirements, technological advancements, and the growing need for efficient air traffic management. These elements collectively contribute to a favorable environment for investment and innovation within the ADS-B sector.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry. Innovations in satellite communication and data processing capabilities have led to more efficient and reliable ADS-B systems. For example, the integration of ADS-B with other surveillance technologies, such as radar and satellite-based systems, enhances the accuracy of aircraft positioning. This synergy is likely to attract investments, as stakeholders recognize the potential for improved operational efficiencies. The market is anticipated to grow at a CAGR of 20.61% from 2025 to 2035, reflecting the increasing demand for advanced surveillance solutions that ensure safety and efficiency in air traffic management.

Enhanced Safety and Security

Enhanced safety and security are paramount concerns within the Global Automatic Dependent Surveillance-Broadcast (ADS-B) Industry. The technology provides real-time information on aircraft positions, which is crucial for collision avoidance and situational awareness. This capability is particularly vital in regions with high traffic density and challenging terrain. Moreover, the integration of ADS-B with other safety systems can further bolster aviation security. As stakeholders prioritize safety, the demand for ADS-B systems is expected to rise, contributing to the overall market growth. The increasing focus on safety measures is likely to play a significant role in achieving the projected market size of 33.6 USD Billion in 2024.