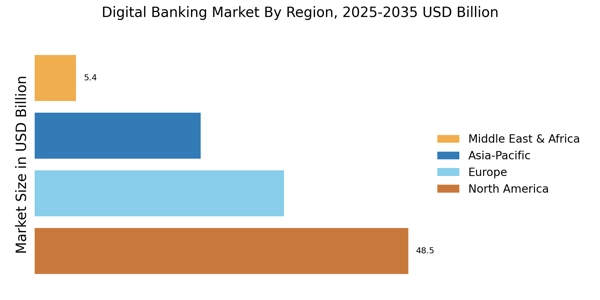

North America : Digital Banking Market Leader

North America holds the largest share of the digital banking market US, driven by high smartphone penetration and advanced bank digital marketing solutions. The U.S. and Canada remain leaders, with strong growth in the Canada digital banking market supported by innovation-friendly regulations.North America is the largest market for digital banking, holding approximately 45% of the global market share. The region's growth is driven by high internet penetration, increasing smartphone usage, and a strong regulatory framework that encourages innovation. The demand for seamless digital experiences and enhanced security measures are key trends fueling this growth. The U.S. is the largest market, followed by Canada, which contributes significantly to the overall digital banking landscape. The competitive landscape in North America is characterized by major players such as JPMorgan Chase, Bank of America, and Wells Fargo. These institutions are investing heavily in technology to enhance customer experience and streamline operations. The presence of fintech companies is also reshaping the market, offering innovative solutions that challenge traditional banking models. The regulatory environment supports these advancements, ensuring consumer protection while fostering competition.

Europe : Emerging Digital Banking Market Hub

Europe is witnessing rapid growth in the digital banking sector, accounting for approximately 30% of the global market share. Europe accounts for approximately 30% of global market share. Growth is driven by regulatory initiatives and strong adoption across the France digital banking market, Germany digital banking market, Italy digital banking market, and Spain digital banking market. The region benefits from a strong regulatory framework, including the PSD2 directive, which promotes competition and innovation. Demand for digital banking services is increasing, driven by changing consumer preferences and the need for more efficient banking solutions. The UK and Germany are the largest markets, with significant contributions from France and the Nordics. Leading countries in Europe are home to major players like HSBC, Barclays, and BNP Paribas, which are investing in digital transformation to enhance customer engagement. The competitive landscape is evolving, with fintech startups emerging alongside traditional banks, creating a dynamic environment. The European Central Bank's initiatives to support digital finance further bolster the region's position as a digital banking hub.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly emerging as a significant player in the digital banking market, holding approximately 20% of the global market share. Asia-Pacific is witnessing rapid expansion due to government digital initiatives and fintech innovation. China dominates the China digital banking market, followed by growth in the Japan digital banking market and South Korea digital banking market. The region's growth is fueled by a large unbanked population, increasing smartphone penetration, and a growing middle class. Countries like China and India are leading the charge, with government initiatives promoting digital financial services. The demand for convenient and accessible banking solutions is driving innovation in this sector. China is the largest market in the region, with major players like Alibaba and Tencent revolutionizing the banking landscape through their digital platforms. India follows closely, with a surge in fintech startups and government-backed initiatives like the Digital India program. The competitive landscape is characterized by a mix of traditional banks and agile fintech companies, creating a vibrant ecosystem that fosters innovation and customer-centric solutions.

Middle East and Africa : Emerging Market Potential

MEA holds around 5% market share, with increasing momentum across the GCC digital banking market. Digital infrastructure investments and fintech ecosystems are accelerating adoption. The Middle East and Africa region is witnessing a burgeoning digital banking market, accounting for approximately 5% of the global market share. The growth is driven by increasing internet penetration, mobile banking adoption, and a young population eager for digital solutions. Countries like South Africa and the UAE are leading the way, with significant investments in fintech and digital banking infrastructure. Regulatory support is also enhancing the market's potential, encouraging innovation and competition. In South Africa, major banks are investing in digital platforms to enhance customer experience, while the UAE is positioning itself as a fintech hub in the region. The competitive landscape is diverse, with both established banks and new entrants vying for market share. The presence of international players is also increasing, further enriching the market dynamics and offering consumers a wider range of services.