Enhanced User Experience

The Bitcoin ATM Machine Market is experiencing a transformation due to advancements in user interface design and technology. Modern Bitcoin ATMs are increasingly user-friendly, featuring intuitive screens and simplified transaction processes. This enhancement is crucial in attracting a broader demographic, including those who may be less tech-savvy. As of 2025, the user experience is a pivotal factor in the growth of the market, with many machines now offering multilingual support and faster transaction times. This focus on user experience not only encourages more transactions but also fosters trust in the technology, thereby propelling the Bitcoin ATM Machine Market forward.

Expansion of Retail Locations

The proliferation of Bitcoin ATMs in retail locations is a significant driver for the Bitcoin ATM Machine Market. As retailers recognize the potential for increased foot traffic and sales, many are opting to install Bitcoin ATMs on their premises. By October 2025, it is projected that the number of Bitcoin ATMs in retail environments will have increased by over 50% compared to previous years. This expansion not only provides consumers with greater access to cryptocurrency transactions but also integrates Bitcoin ATMs into the mainstream shopping experience. The Bitcoin ATM Machine Market stands to gain substantially from this trend, as more locations become available for users.

Regulatory Clarity and Compliance

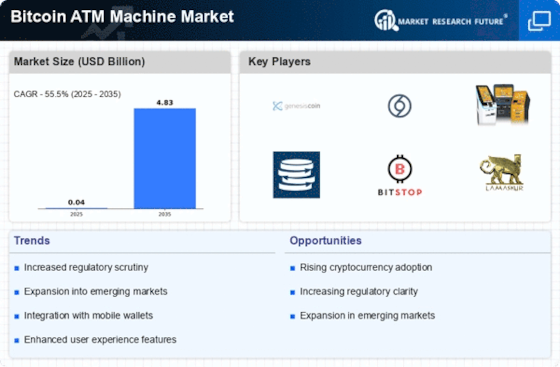

The Bitcoin ATM Machine Market is positively influenced by the evolving regulatory landscape surrounding cryptocurrencies. As governments and regulatory bodies establish clearer guidelines, the legitimacy of Bitcoin ATMs is reinforced. In 2025, many jurisdictions have implemented regulations that require Bitcoin ATMs to comply with anti-money laundering (AML) and know your customer (KYC) protocols. This compliance not only enhances the credibility of Bitcoin ATMs but also encourages more users to engage with these machines, knowing they operate within a legal framework. Consequently, the Bitcoin ATM Machine Market is likely to see increased growth as regulatory clarity fosters consumer confidence.

Growing Adoption of Cryptocurrencies

The increasing acceptance of cryptocurrencies as a legitimate form of payment is a primary driver for the Bitcoin ATM Machine Market. As more businesses and consumers recognize the utility of digital currencies, the demand for Bitcoin ATMs rises. In 2025, it is estimated that over 300 million people worldwide own cryptocurrencies, which significantly boosts the need for accessible points of exchange. This trend indicates a shift in consumer behavior towards digital assets, thereby enhancing the relevance of Bitcoin ATMs in everyday transactions. The Bitcoin ATM Machine Market is likely to benefit from this growing adoption, as users seek convenient ways to buy and sell cryptocurrencies.

Technological Advancements in Security

The Bitcoin ATM Machine Market is significantly impacted by ongoing technological advancements in security features. As concerns about fraud and cyber threats grow, manufacturers are increasingly incorporating advanced security measures into Bitcoin ATMs. By 2025, features such as biometric authentication, end-to-end encryption, and real-time transaction monitoring are becoming standard. These enhancements not only protect users but also build trust in the technology, encouraging more individuals to utilize Bitcoin ATMs. The emphasis on security is likely to drive further growth in the Bitcoin ATM Machine Market, as users feel more secure in their transactions.