China : Unmatched Growth and Innovation

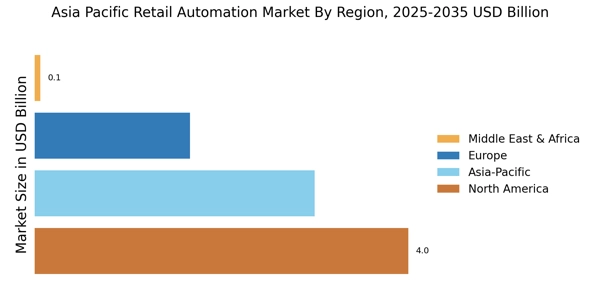

China holds a commanding market share of 40% in the APAC retail automation sector, valued at $1500.0 million. Key growth drivers include rapid urbanization, increasing consumer spending, and a robust e-commerce ecosystem. Government initiatives like the "Made in China 2025" policy promote technological advancements, while significant investments in infrastructure enhance logistics and distribution networks. The demand for smart retail solutions is surging, driven by changing consumer preferences and the need for operational efficiency.

India : Evolving Consumer Preferences Drive Demand

India's retail automation market is valued at $800.0 million, accounting for 20% of the APAC market. The growth is fueled by increasing smartphone penetration, a burgeoning middle class, and government initiatives like Digital India. The demand for automated solutions is rising, particularly in urban areas, as retailers seek to enhance customer experiences and streamline operations. Regulatory support for foreign investments further bolsters market potential, while infrastructure improvements are critical for logistics efficiency.

Japan : Advanced Solutions for Competitive Edge

Japan's retail automation market is valued at $600.0 million, representing 15% of the APAC market. The growth is driven by a tech-savvy population and a strong focus on innovation. Government policies promoting automation in various sectors, including retail, are pivotal. The demand for advanced solutions like AI and robotics is increasing, particularly in urban centers like Tokyo and Osaka, where consumer expectations are high. The competitive landscape features major players like Panasonic and Toshiba, enhancing local market dynamics.

South Korea : Integration of Technology and Retail

South Korea's retail automation market is valued at $500.0 million, capturing 12.5% of the APAC market. The growth is propelled by high internet penetration and a tech-oriented consumer base. Government initiatives supporting smart city projects and digital transformation in retail are significant. Key markets include Seoul and Busan, where major retailers are adopting automated solutions to enhance customer engagement. Companies like Samsung and NCR Corporation are leading the charge in this competitive landscape.

Malaysia : Growth Driven by E-commerce Boom

Malaysia's retail automation market is valued at $250.0 million, accounting for 6.25% of the APAC market. The growth is driven by the rapid expansion of e-commerce and increasing consumer demand for convenience. Government initiatives to promote digitalization in retail are crucial, alongside improvements in logistics infrastructure. Key markets include Kuala Lumpur and Penang, where local retailers are increasingly adopting automated solutions. The competitive landscape features both local and international players, enhancing market dynamics.

Thailand : Consumer Demand Fuels Market Growth

Thailand's retail automation market is valued at $200.0 million, representing 5% of the APAC market. The growth is driven by rising consumer expectations and the expansion of the retail sector. Government policies supporting digital transformation and infrastructure development are key growth factors. Major cities like Bangkok are witnessing increased adoption of automated solutions. The competitive landscape includes both local and international players, creating a dynamic business environment for retail automation.

Indonesia : Market Potential in Emerging Economy

Indonesia's retail automation market is valued at $150.0 million, capturing 3.75% of the APAC market. The growth is driven by a young, tech-savvy population and increasing smartphone usage. Government initiatives aimed at enhancing digital infrastructure are pivotal. Key markets include Jakarta and Surabaya, where local retailers are beginning to adopt automated solutions. The competitive landscape is evolving, with both local startups and international players vying for market share, creating a vibrant business environment.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC retail automation market is valued at $914.64 million, representing 22.5% of the overall APAC market. Growth is driven by varying consumer behaviors and technological adoption across different countries. Government initiatives supporting digital transformation and infrastructure improvements are crucial. Key markets include Vietnam and the Philippines, where local retailers are increasingly adopting automated solutions. The competitive landscape features a mix of local and international players, enhancing market dynamics.