Growing Focus on Data Security

Data security concerns are becoming increasingly prominent within the Artificial Intelligence of Things Market. As more devices become interconnected, the potential for cyber threats escalates. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, underscoring the urgent need for robust security measures. Companies are now prioritizing the development of secure AI solutions that can protect sensitive data while maintaining functionality. This focus on security is driving investments in AI technologies that enhance threat detection and response capabilities. As organizations seek to safeguard their operations and customer information, the demand for secure AI-driven IoT solutions is likely to rise, further propelling the growth of the Artificial Intelligence of Things Market.

Rising Adoption of Smart Cities

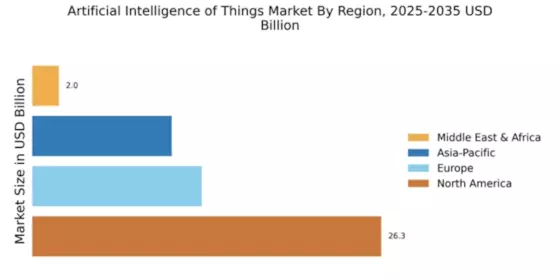

The concept of smart cities is gaining traction, serving as a significant driver for the Artificial Intelligence of Things Market. Urban areas are increasingly implementing IoT technologies to enhance infrastructure, improve public services, and promote sustainability. By 2025, it is anticipated that investments in smart city initiatives will exceed 1 trillion dollars, highlighting the potential for AI integration. Smart city projects often rely on AI to analyze data from various sources, enabling better resource management and improved quality of life for residents. As cities strive to become more efficient and responsive, the demand for AI-driven IoT solutions is likely to grow, thereby propelling the Artificial Intelligence of Things Market forward.

Advancements in Machine Learning

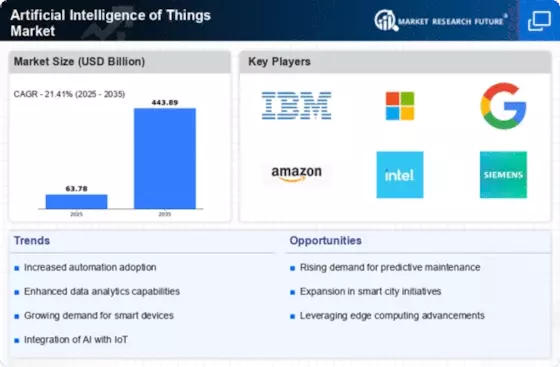

Machine learning advancements are significantly influencing the Artificial Intelligence of Things Market. The evolution of algorithms and computational power has enabled more sophisticated data analysis and decision-making processes. In 2025, the machine learning segment is expected to account for a substantial share of the AI market, with a projected growth rate of over 40 percent. This rapid development allows for real-time data processing, which is crucial for IoT applications. As industries such as healthcare, manufacturing, and transportation increasingly rely on data-driven insights, the integration of machine learning into IoT systems becomes essential. This trend not only enhances operational efficiency but also fosters innovation within the Artificial Intelligence of Things Market, as companies seek to leverage these technologies for competitive advantage.

Increased Demand for Smart Devices

The proliferation of smart devices is a primary driver of the Artificial Intelligence of Things Market. As consumers and businesses increasingly adopt smart technologies, the need for AI integration becomes apparent. In 2025, the number of connected devices is projected to reach 75 billion, indicating a substantial market opportunity. This surge in device connectivity necessitates advanced AI algorithms to process and analyze data efficiently. Consequently, manufacturers are compelled to innovate and enhance their offerings, leading to a more competitive landscape. The integration of AI with IoT devices not only improves functionality but also enhances user experience, thereby driving further adoption. As a result, the Artificial Intelligence of Things Market is likely to witness significant growth, fueled by the escalating demand for smarter, more efficient devices.

Integration of AI in Industrial Automation

The integration of AI in industrial automation is a pivotal driver for the Artificial Intelligence of Things Market. Industries are increasingly adopting AI technologies to optimize production processes, reduce downtime, and enhance overall efficiency. In 2025, the industrial automation sector is projected to reach a market value of 300 billion dollars, with AI playing a crucial role in this transformation. By leveraging AI algorithms, manufacturers can analyze vast amounts of data from IoT devices to make informed decisions in real-time. This capability not only streamlines operations but also fosters innovation in product development. As industries continue to embrace automation, the demand for AI-integrated IoT solutions is expected to surge, significantly impacting the growth trajectory of the Artificial Intelligence of Things Market.