Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the Artificial Intelligence (AI) in Security Market. Organizations are facing a surge in cyberattacks, with data indicating that ransomware attacks alone have escalated by over 150% in recent years. This alarming trend compels businesses to adopt advanced security measures, including AI-driven solutions that can analyze vast amounts of data in real-time. AI technologies enhance threat detection capabilities, enabling organizations to identify and respond to potential breaches more effectively. As the landscape of cyber threats continues to evolve, the demand for AI in security solutions is expected to grow, with the market projected to reach substantial figures in the coming years.

Advancements in AI Technology

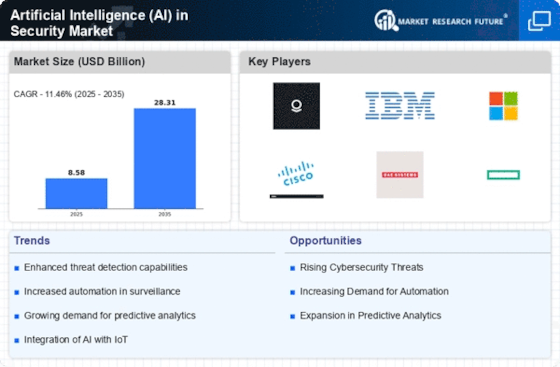

The rapid advancements in AI technology are significantly influencing the Artificial Intelligence (AI) in Security Market. Innovations in machine learning, natural language processing, and predictive analytics are enhancing the capabilities of security solutions. These technologies enable systems to learn from historical data, identify patterns, and predict potential threats with remarkable accuracy. The market for AI in security is projected to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the next few years. As organizations seek to leverage these advancements to bolster their security posture, the demand for AI-driven solutions is likely to increase, driving further investment in the sector.

Regulatory Compliance Requirements

The stringent regulatory landscape surrounding data protection and privacy is a significant driver for the Artificial Intelligence (AI) in Security Market. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on organizations to safeguard sensitive information. Compliance with these regulations necessitates the implementation of robust security measures, where AI technologies play a crucial role. AI can automate compliance processes, monitor data access, and ensure that organizations adhere to legal standards. As businesses strive to avoid hefty fines and reputational damage, the integration of AI in security frameworks becomes increasingly vital, thereby propelling market growth.

Increased Investment in Security Solutions

The growing recognition of the importance of cybersecurity has led to increased investment in security solutions, acting as a catalyst for the Artificial Intelligence (AI) in Security Market. Organizations are allocating larger budgets to enhance their security infrastructure, with spending on cybersecurity expected to exceed hundreds of billions in the near future. This trend reflects a proactive approach to mitigating risks associated with cyber threats. AI technologies are at the forefront of these investments, as they offer scalable and efficient solutions for threat detection and response. The influx of capital into AI-driven security solutions is likely to accelerate innovation and expand the market, as companies seek to stay ahead of emerging threats.

Integration of AI with Existing Security Systems

The integration of AI with existing security systems is a pivotal driver for the Artificial Intelligence (AI) in Security Market. Organizations are increasingly recognizing the need to enhance their current security frameworks by incorporating AI technologies. This integration allows for improved data analysis, real-time monitoring, and automated responses to security incidents. As businesses strive for a more cohesive security strategy, the demand for AI solutions that can seamlessly integrate with legacy systems is on the rise. This trend not only enhances the effectiveness of security measures but also optimizes resource allocation, making it a compelling factor for organizations looking to bolster their defenses against evolving threats.