Market Growth Projections

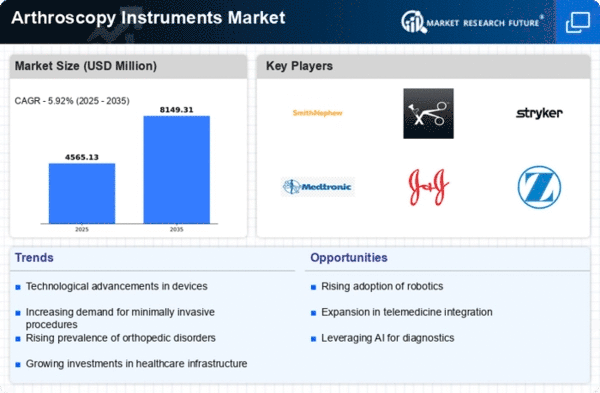

The Global Arthroscopy Instruments Market Industry is poised for substantial growth, with projections indicating a market value of 3.21 USD Billion in 2024 and an anticipated increase to 7.69 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 8.26% from 2025 to 2035. Such figures underscore the increasing adoption of arthroscopic techniques and the continuous advancements in surgical instruments, reflecting a robust market environment.

Rising Awareness and Education

The Global Arthroscopy Instruments Market Industry is benefiting from increased awareness and education regarding arthroscopic procedures among both healthcare professionals and patients. Educational programs and workshops are being organized to inform surgeons about the latest techniques and instruments available. Additionally, patients are becoming more informed about their treatment options, leading to a higher demand for arthroscopic surgeries. This growing awareness is likely to drive market growth, as more individuals seek out these advanced surgical options.

Government Initiatives and Funding

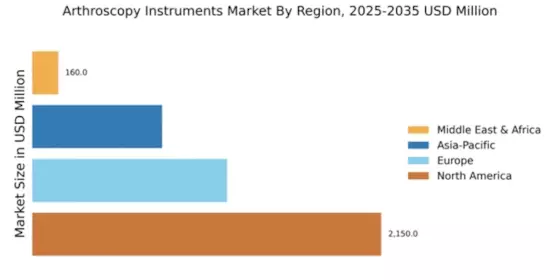

Government initiatives aimed at improving healthcare infrastructure and funding for surgical innovations are pivotal for the Global Arthroscopy Instruments Market Industry. Many countries are investing in advanced medical technologies to enhance surgical outcomes and reduce healthcare costs. For instance, various health departments are providing grants and subsidies for the development of arthroscopic instruments and training programs for surgeons. Such initiatives not only promote the adoption of arthroscopy but also ensure that healthcare systems are equipped with the latest technologies, thereby fostering market growth.

Rising Prevalence of Orthopedic Disorders

The Global Arthroscopy Instruments Market Industry is experiencing growth due to the increasing prevalence of orthopedic disorders, such as osteoarthritis and sports injuries. As populations age and engage in more physical activities, the demand for minimally invasive surgical procedures rises. For instance, the World Health Organization indicates that musculoskeletal disorders affect millions globally, leading to a surge in arthroscopic surgeries. This trend is expected to contribute to the market's expansion, with projections estimating the market value to reach 3.21 USD Billion in 2024, and potentially 7.69 USD Billion by 2035, reflecting a robust CAGR of 8.26% from 2025 to 2035.

Technological Advancements in Arthroscopy

Technological innovations play a crucial role in the Global Arthroscopy Instruments Market Industry. The introduction of advanced imaging techniques, such as 3D visualization and robotic-assisted surgery, enhances surgical precision and patient outcomes. These advancements not only improve the efficiency of arthroscopic procedures but also reduce recovery times, thereby increasing patient satisfaction. For example, the integration of augmented reality in surgical planning is becoming more prevalent. As these technologies evolve, they are likely to attract more healthcare providers to adopt arthroscopic techniques, further driving market growth.

Increasing Demand for Minimally Invasive Procedures

The Global Arthroscopy Instruments Market Industry is significantly influenced by the rising demand for minimally invasive surgical procedures. Patients increasingly prefer surgeries that promise reduced pain, shorter recovery times, and minimal scarring. Arthroscopy, being a minimally invasive technique, aligns perfectly with these patient preferences. The growing awareness of the benefits associated with such procedures is prompting healthcare providers to adopt arthroscopic techniques more widely. This shift is expected to bolster the market, as more patients opt for arthroscopic interventions over traditional open surgeries.