Arthroscopy Instruments Size

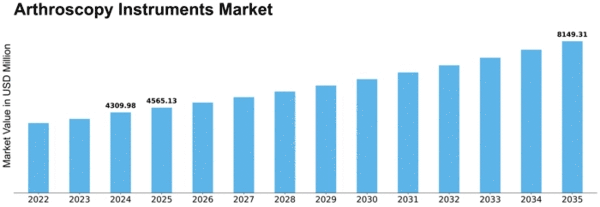

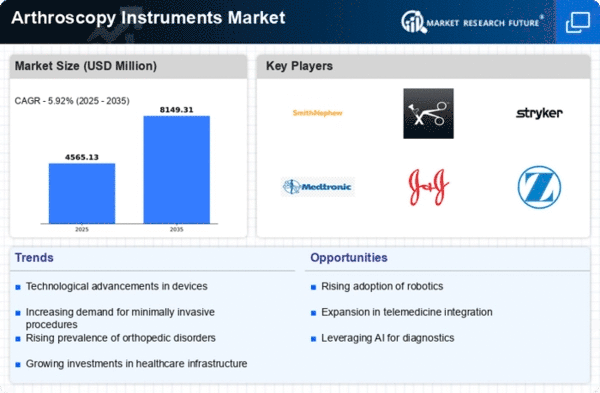

Arthroscopy Instruments Market Growth Projections and Opportunities

Recent years have seen a notable increase in the market for arthroscopy instruments, mostly due to the development of medical technology and the rising incidence of joint-related illnesses. The minimally invasive surgical technique known as arthroscopy has grown in favor due to its efficiency in identifying and treating joint disorders. Growing Rate of Joint Problems: The rising prevalence of joint conditions including rheumatoid arthritis and osteoarthritis is a major factor driving market trends. The aging population and sedentary lifestyles have led to an increase in joint-related problems, which has increased demand for arthroscopy operations and accompanying equipment. technical advancements: Manufacturers are always creating and releasing cutting-edge arthroscopy tools, and this is causing a boom in technical advancements in the market. These advancements, which improve the general effectiveness and results of arthroscopic treatments, include robotically assisted surgical instruments, high-definition imaging systems, and precision instruments. Anthropogenic Sports Injuries: athletic-related injuries, particularly those involving the joints, are on the rise as a result of people engaging in more leisure and athletic activities. The need for specific equipment made for sports medicine applications has increased as arthroscopy has emerged as the primary technique for identifying and treating these kinds of injuries. Transition to Minimally Invasive Surgery: As a result of advantages including quicker recovery periods, less discomfort following surgery, and a decreased chance of problems, patients and medical professionals are choosing minimally invasive surgical techniques more frequently. The use of arthroscopy tools is being driven by arthroscopy, which is in perfect alignment with this trend. Expanding Healthcare Infrastructure: Access to modern medical treatments, such as arthroscopy, has been made easier by advancements in healthcare infrastructure, especially in emerging nations. As a result, there are now more patients available for arthroscopic procedures, which is driving market expansion. Enhanced Knowledge and Sensitization: An important factor in the market's growth has been the growing knowledge of arthroscopy's advantages among medical professionals and patients alike. The broad use of arthroscopy devices has been facilitated by educational initiatives and training programs that have expanded the skill set of surgeons in relation to arthroscopic methods.

Leave a Comment