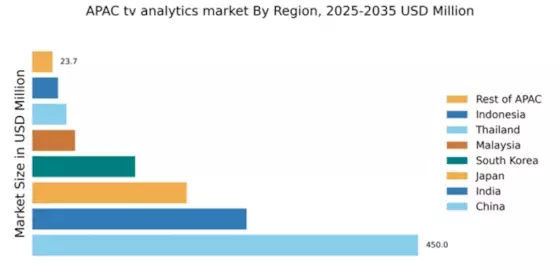

China : Unmatched Growth and Innovation

China holds a commanding market share of 45% in the APAC TV analytics sector, valued at $450.0 million. Key growth drivers include rapid digital transformation, increasing internet penetration, and a burgeoning middle class demanding personalized content. Government initiatives like the Digital China strategy are fostering innovation, while robust infrastructure supports the expansion of OTT platforms and smart TVs, driving consumption patterns towards on-demand viewing.

India : Diverse Audience and Content Demand

India's TV analytics market is valued at $250.0 million, capturing 25% of the APAC share. The growth is fueled by a diverse population with varied content preferences, alongside increasing smartphone usage and affordable data plans. Government initiatives like Digital India are enhancing digital infrastructure, promoting OTT platforms, and encouraging local content production, which is reshaping consumption patterns towards regional languages and genres.

Japan : Precision and Quality in Measurement

Japan's TV analytics market, valued at $180.0 million, represents 18% of the APAC market. The growth is driven by high consumer expectations for quality content and advanced technology adoption. Regulatory frameworks support data privacy and consumer rights, while the government promotes innovation in media technologies. The demand for precise audience measurement is increasing, particularly in urban areas with high media consumption.

South Korea : Strong Demand for Interactive Content

South Korea's market, valued at $120.0 million, accounts for 12% of the APAC TV analytics sector. The growth is propelled by a tech-savvy population and a strong preference for interactive and on-demand content. Government policies support the development of smart broadcasting technologies, while the competitive landscape features major players like Nielsen and Market Research Future, focusing on real-time analytics and viewer engagement metrics.

Malaysia : Cultural Diversity Drives Content Choices

Malaysia's TV analytics market is valued at $50.0 million, capturing 5% of the APAC share. The growth is driven by a multicultural population with diverse content preferences, alongside increasing internet access. Government initiatives to promote digital content and local productions are enhancing market dynamics. Key cities like Kuala Lumpur and Penang are emerging as significant markets for analytics services.

Thailand : Cultural Shifts Influence Consumption

Thailand's TV analytics market, valued at $40.0 million, represents 4% of the APAC sector. The growth is influenced by changing cultural dynamics and a rise in mobile viewership. Government policies promoting digital transformation and local content production are reshaping the landscape. Bangkok is a key market, with local players competing alongside international firms to capture audience insights effectively.

Indonesia : Rapid Growth in Digital Consumption

Indonesia's TV analytics market is valued at $30.0 million, accounting for 3% of the APAC share. The growth is driven by a young population and increasing smartphone penetration. Government initiatives to improve digital infrastructure and promote local content are fostering demand. Key cities like Jakarta and Surabaya are pivotal markets, with local players emerging to meet the growing analytics needs.

Rest of APAC : Fragmented Landscape of Opportunities

The Rest of APAC market, valued at $23.7 million, represents 2% of the overall sector. This region encompasses a variety of markets with unique consumption patterns and regulatory environments. Growth is driven by increasing internet access and mobile viewership across smaller nations. Local players are adapting to diverse cultural preferences, while international firms explore partnerships to enhance their reach.