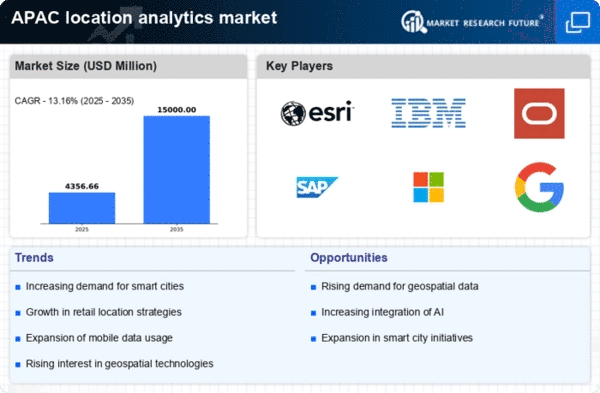

Expansion of Smart Cities

The rapid development of smart cities across the APAC region is a pivotal driver for the location analytics market. Governments are increasingly investing in infrastructure that integrates advanced technologies, including IoT and data analytics, to enhance urban living. This trend is expected to propel the demand for location analytics solutions, as they provide critical insights into urban planning, traffic management, and resource allocation. According to recent estimates, the smart city market in APAC is projected to reach approximately $1 trillion by 2025, indicating a substantial opportunity for location analytics providers. The integration of location-based services within smart city frameworks allows for improved decision-making and operational efficiency, thereby fostering a conducive environment for the growth of the location analytics market.

Rise in Mobile Device Usage

The proliferation of mobile devices in the APAC region significantly influences the location analytics market. With an increasing number of individuals relying on smartphones and tablets for daily activities, businesses are leveraging location data to enhance customer engagement and optimize service delivery. Recent statistics suggest that mobile penetration in APAC is expected to exceed 80% by 2025, creating a vast pool of location data that can be harnessed for analytics. This trend not only aids in understanding consumer behavior but also facilitates targeted marketing strategies, thereby driving revenue growth for businesses. Consequently, the demand for location analytics solutions that can process and analyze mobile location data is likely to surge, further propelling the location analytics market.

Increased Focus on Retail Analytics

The retail sector in APAC is undergoing a transformation, with businesses increasingly focusing on location analytics to enhance operational efficiency and customer experience. Retailers are utilizing location data to analyze foot traffic, optimize store placements, and tailor marketing strategies to specific demographics. Recent studies indicate that the retail analytics market in APAC is anticipated to grow at a CAGR of over 15% through 2025, highlighting the rising importance of data-driven insights. As retailers strive to remain competitive in a dynamic market, the demand for location analytics solutions that provide actionable insights is likely to escalate, thereby driving growth in the location analytics market.

E-commerce Growth and Logistics Optimization

The booming e-commerce sector in APAC is a crucial driver for the location analytics market. As online shopping continues to gain traction, businesses are increasingly focusing on logistics and supply chain optimization to meet consumer demands. Location analytics plays a vital role in this context, enabling companies to analyze delivery routes, manage inventory, and enhance customer satisfaction. Recent reports indicate that the e-commerce market in APAC is projected to surpass $2 trillion by 2025, underscoring the need for efficient logistics solutions. By leveraging location data, businesses can streamline operations and reduce costs, thereby fostering a favorable environment for the growth of the location analytics market.

Government Initiatives for Data-Driven Decision Making

Governments across the APAC region are increasingly adopting data-driven decision-making processes, which significantly impacts the location analytics market. Initiatives aimed at enhancing public services, urban planning, and disaster management are driving the demand for location analytics solutions. For instance, various governments are implementing policies that encourage the use of geospatial data to improve infrastructure and service delivery. This trend is expected to create a robust market for location analytics, as public sector entities seek to harness location data for better governance. The potential for collaboration between government agencies and private sector firms further amplifies the opportunities within the location analytics market.