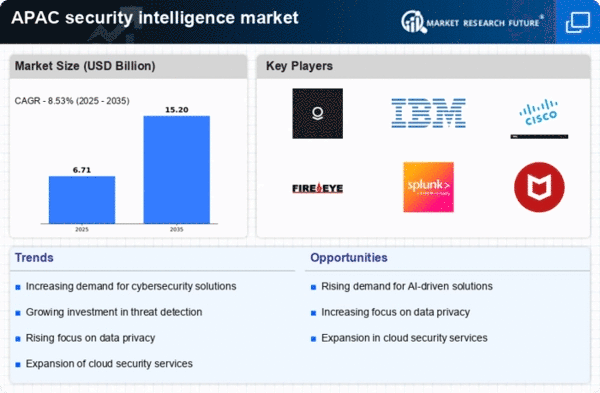

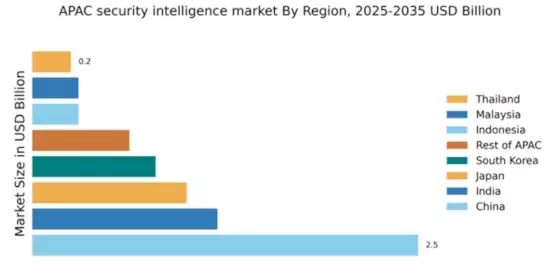

China : Robust Growth Driven by Innovation

China holds a commanding market share of 2.5 in the APAC security intelligence sector, driven by rapid technological advancements and increasing cyber threats. The government's push for digital transformation and smart city initiatives has fueled demand for security solutions. Regulatory frameworks are evolving, with stricter data protection laws enhancing the need for robust security measures. Infrastructure development, particularly in urban areas, is also a significant growth driver, as businesses seek to safeguard their digital assets.

India : Rapid Digitalization Fuels Demand

India's security intelligence market is valued at 1.2, reflecting a growing awareness of cybersecurity threats among businesses. Key growth drivers include the rapid digitalization of industries and increasing investments in IT infrastructure. Government initiatives like Digital India are promoting the adoption of advanced security solutions. The demand for cloud-based security services is rising, driven by the shift towards remote work and online services, creating a favorable consumption pattern.

Japan : Focus on Innovation and Compliance

Japan's market share stands at 1.0, characterized by a strong emphasis on technological innovation and compliance with stringent regulations. The government is actively promoting cybersecurity initiatives, particularly in critical sectors like finance and healthcare. The demand for AI-driven security solutions is on the rise, as organizations seek to enhance their threat detection capabilities. The market is also influenced by the increasing frequency of cyberattacks, prompting businesses to invest in advanced security measures.

South Korea : Government Support and Industry Growth

South Korea's security intelligence market is valued at 0.8, supported by a robust cybersecurity framework and government initiatives. The country has implemented various policies to enhance national cybersecurity, including the Cybersecurity Act. The demand for integrated security solutions is growing, driven by the increasing complexity of cyber threats. Local businesses are increasingly adopting advanced security technologies to protect sensitive data, reflecting a proactive approach to cybersecurity.

Malaysia : Investment in Security Infrastructure

Malaysia's market share is 0.3, with a growing recognition of the importance of cybersecurity among businesses. Key growth drivers include increased cyber threats and government initiatives aimed at enhancing national cybersecurity. The Malaysian government has launched various programs to promote cybersecurity awareness and investment in security infrastructure. The demand for managed security services is rising, as organizations seek to outsource their security needs to specialized providers.

Thailand : Focus on Regulatory Compliance

Thailand's security intelligence market is valued at 0.25, with a focus on regulatory compliance and risk management. The government is actively working to enhance cybersecurity measures through initiatives like the Cybersecurity Act. The demand for security solutions is increasing, driven by the growing number of cyber incidents. Businesses are investing in security technologies to comply with regulations and protect their digital assets, reflecting a shift towards a more security-conscious environment.

Indonesia : Digital Transformation Driving Demand

Indonesia's market share is 0.3, with rapid growth driven by digital transformation across various sectors. The government is promoting cybersecurity initiatives to address the increasing threat landscape. The demand for security solutions is rising, particularly in sectors like finance and e-commerce, where data protection is critical. Local businesses are increasingly aware of the need for robust security measures, leading to a growing market for security intelligence solutions.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market is valued at 0.63, characterized by diverse growth patterns and unique challenges. Different countries in this sub-region are at varying stages of cybersecurity maturity, influencing demand for security solutions. Government initiatives and regulatory frameworks are evolving, impacting market dynamics. The competitive landscape includes both local and international players, with a focus on tailored solutions to meet specific regional needs, reflecting a fragmented but growing market.