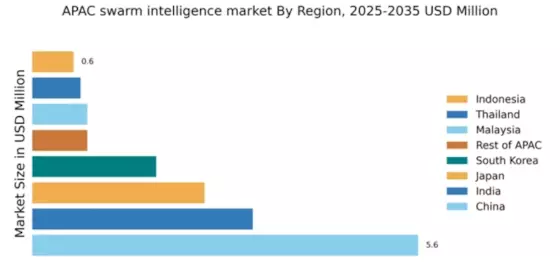

China : Rapid Growth and Innovation Hub

Key markets include Beijing, Shanghai, and Shenzhen, where tech giants like Alibaba and Tencent are heavily investing in swarm intelligence applications. The competitive landscape features major players like Siemens and IBM, who are collaborating with local firms to tailor solutions. The business environment is dynamic, with a focus on sectors like logistics, manufacturing, and smart transportation, driving further adoption of swarm intelligence technologies.

India : Innovation and Start-up Ecosystem

Bangalore, Delhi, and Mumbai are pivotal markets, hosting numerous tech start-ups and established players like Microsoft and IBM. The competitive landscape is vibrant, with local firms innovating in sectors such as agriculture, healthcare, and logistics. The business environment is conducive to growth, supported by favorable policies and a skilled workforce, making India a hotspot for swarm intelligence applications.

Japan : Integration of AI and Robotics

Tokyo and Osaka are key markets, with major players like Siemens and Schneider Electric leading the charge. The competitive landscape is marked by collaboration between tech firms and traditional industries, enhancing the adoption of swarm intelligence. Sectors such as manufacturing, healthcare, and transportation are increasingly leveraging these technologies to improve efficiency and productivity.

South Korea : Government Support and Investment

Seoul and Busan are key markets, with significant investments from companies like Samsung and LG. The competitive landscape features a mix of local and international players, creating a dynamic business environment. Sectors such as urban planning, transportation, and energy management are increasingly adopting swarm intelligence solutions to enhance operational efficiency and sustainability.

Malaysia : Strategic Location for Tech Development

Kuala Lumpur and Penang are key markets, attracting both local and international players. The competitive landscape includes firms like Honeywell and Cisco Systems, who are establishing a presence in the region. The business environment is evolving, with a focus on enhancing digital capabilities and fostering innovation in various sectors, including smart cities and industrial automation.

Thailand : Focus on Smart Solutions and Innovation

Bangkok and Chiang Mai are key markets, with significant investments from local and international firms. The competitive landscape features players like IBM and Oracle, who are collaborating with local businesses to tailor solutions. The business environment is supportive of innovation, with a focus on enhancing infrastructure and digital capabilities across various sectors.

Indonesia : Focus on Digital Transformation

Jakarta and Surabaya are key markets, with local firms beginning to explore swarm intelligence applications. The competitive landscape is still developing, with opportunities for international players like Microsoft and Cisco to establish a foothold. The business environment is evolving, with a focus on enhancing digital infrastructure and fostering innovation in sectors such as e-commerce and logistics.

Rest of APAC : Varied Market Dynamics and Growth

Countries like Vietnam and the Philippines are emerging markets within this segment, with local players beginning to explore swarm intelligence applications. The competitive landscape is fragmented, with opportunities for both local and international firms to innovate. Sectors such as agriculture, logistics, and smart cities are increasingly adopting swarm intelligence solutions to enhance efficiency and productivity.