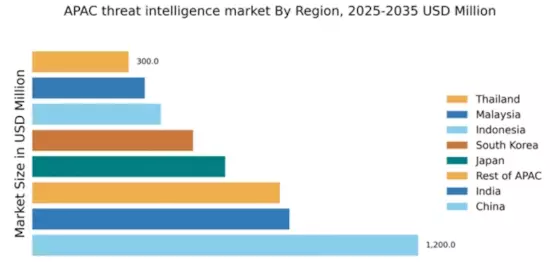

China : Robust Growth Driven by Innovation

China holds a commanding market share of 30% in the APAC threat intelligence sector, valued at $1200.0 million. Key growth drivers include rapid digital transformation, increasing cyber threats, and government initiatives promoting cybersecurity. The demand for advanced threat detection solutions is rising, supported by regulatory policies like the Cybersecurity Law, which mandates stringent data protection measures. Infrastructure development, particularly in tech hubs like Beijing and Shenzhen, further fuels market expansion.

India : Rapid Growth in Cybersecurity Needs

India's threat intelligence market is valued at $800.0 million, accounting for 20% of the APAC share. The surge in cyberattacks and the push for digitalization across sectors are key growth drivers. Government initiatives like the National Cyber Security Policy aim to bolster cybersecurity frameworks. The increasing adoption of cloud services and IoT devices is also driving demand for threat intelligence solutions.

Japan : Strong Focus on Innovation and Security

Japan's market for threat intelligence stands at $600.0 million, representing 15% of the APAC market. The country's emphasis on technological innovation and stringent cybersecurity regulations are significant growth factors. The government has implemented policies to enhance national security, including the Cybersecurity Strategy. Demand is particularly high in sectors like finance and manufacturing, where data protection is critical.

South Korea : Government Support and Industry Growth

South Korea's threat intelligence market is valued at $500.0 million, capturing 12.5% of the APAC share. The government's proactive stance on cybersecurity, including the Cybersecurity Act, drives market growth. The increasing sophistication of cyber threats has led to heightened demand for advanced threat intelligence solutions. Key cities like Seoul are central to this market, hosting major players and tech startups.

Malaysia : Investment in Digital Infrastructure

Malaysia's threat intelligence market is valued at $350.0 million, accounting for 8.75% of the APAC market. The government's Digital Economy Blueprint aims to enhance cybersecurity capabilities, driving demand for threat intelligence solutions. The rise of e-commerce and digital banking is also contributing to market growth. Key cities like Kuala Lumpur are emerging as cybersecurity hubs, attracting investments from major players.

Thailand : Focus on Regulatory Compliance

Thailand's threat intelligence market is valued at $300.0 million, representing 7.5% of the APAC share. The increasing frequency of cyber incidents has prompted businesses to invest in cybersecurity solutions. Government initiatives, such as the Cybersecurity Act, are fostering a more secure digital environment. Bangkok is a key market, with local firms collaborating with international players to enhance their cybersecurity posture.

Indonesia : Rising Threats and Solutions Demand

Indonesia's threat intelligence market is valued at $400.0 million, making up 10% of the APAC market. The rapid digitalization of businesses and increasing cyber threats are driving demand for threat intelligence solutions. Government policies aimed at improving cybersecurity infrastructure are also contributing to market growth. Jakarta is a focal point for cybersecurity investments, with both local and international firms establishing a presence.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market for threat intelligence is valued at $770.0 million, accounting for 19.25% of the overall APAC share. This diverse region experiences varied growth driven by local regulations and market needs. Countries like Vietnam and the Philippines are increasingly focusing on cybersecurity, supported by government initiatives. The competitive landscape includes both local startups and established international players, catering to sector-specific needs.