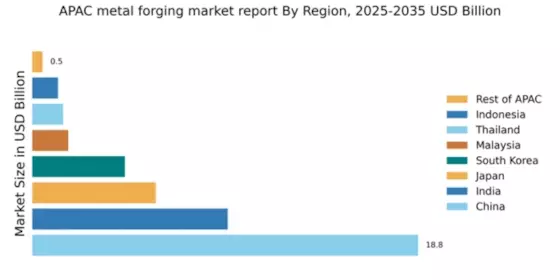

China : Unmatched Growth and Demand Trends

China holds a commanding 18.75% market share in the APAC metal forging sector, driven by rapid industrialization and urbanization. Key growth drivers include a robust automotive industry, increasing infrastructure projects, and government initiatives promoting advanced manufacturing technologies. The demand for high-quality forged products is surging, supported by favorable regulatory policies aimed at enhancing production efficiency and sustainability. Significant investments in infrastructure development further bolster the market's growth potential.

India : Strong Demand from Diverse Sectors

India's metal forging market accounts for 9.5% of the APAC share, fueled by a growing automotive sector and increasing demand for aerospace components. The government's Make in India initiative has spurred local manufacturing, enhancing competitiveness. Regulatory support for foreign investments and technology transfers is also pivotal. The rise in infrastructure projects and renewable energy initiatives is expected to further drive consumption patterns in the coming years.

Japan : Precision and Quality at Forefront

Japan's market share stands at 6.0%, characterized by a focus on high-quality and precision forging. The automotive and electronics industries are primary consumers, driving demand for advanced materials and innovative forging techniques. Government policies promoting R&D in manufacturing technologies are crucial for sustaining growth. The market is also witnessing a shift towards sustainable practices, aligning with global environmental standards.

South Korea : Strategic Investments and Development

South Korea holds a 4.5% share in the metal forging market, supported by strong demand from the automotive and shipbuilding industries. The government's focus on smart manufacturing and Industry 4.0 initiatives is enhancing production capabilities. Key cities like Busan and Ulsan are industrial hubs, fostering a competitive landscape. Major players like Hyundai and Samsung are investing in advanced forging technologies, driving local market dynamics.

Malaysia : Strategic Location for Manufacturing

Malaysia's metal forging market represents 1.75% of the APAC total, with growth driven by its strategic location and favorable trade agreements. The automotive and aerospace sectors are key consumers, supported by government initiatives to boost local manufacturing. The market is characterized by a mix of local and international players, with significant investments in technology and infrastructure development enhancing competitiveness.

Thailand : Key Player in Southeast Asia

Thailand's market share is 1.5%, primarily driven by the automotive industry, which is a significant consumer of forged products. The government's support for the automotive sector through incentives and infrastructure development is crucial for market growth. Key cities like Bangkok and Chonburi are industrial centers, hosting major players like Thai Summit Group. The competitive landscape is evolving with increasing foreign investments and technology adoption.

Indonesia : Potential for Industrial Growth

Indonesia's metal forging market accounts for 1.25% of the APAC share, with growth potential driven by rising industrialization and infrastructure projects. The automotive and construction sectors are primary consumers, supported by government initiatives to enhance local manufacturing capabilities. The competitive landscape is gradually evolving, with local players gaining traction and foreign investments increasing in the sector.

Rest of APAC : Opportunities Across Various Sectors

The Rest of APAC holds a modest 0.5% market share in metal forging, characterized by diverse needs across various sectors. Countries in this category are witnessing gradual industrial growth, with local players focusing on niche markets. Regulatory frameworks are evolving to support manufacturing, while infrastructure development remains a key focus. The competitive landscape is fragmented, with opportunities for innovation and collaboration among smaller players.