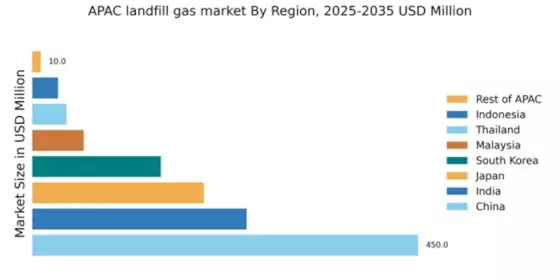

China : Robust Growth Driven by Policy Support

China holds a dominant position in the APAC landfill gas market, accounting for 450.0 million, representing a significant market share. Key growth drivers include stringent environmental regulations and government initiatives aimed at reducing greenhouse gas emissions. The demand for renewable energy sources is rising, supported by investments in infrastructure and waste management technologies. The government has implemented policies to promote landfill gas utilization, enhancing the market's growth potential.

India : Government Initiatives Fueling Growth

India's landfill gas market is valued at 250.0 million, showcasing a growing interest in waste-to-energy solutions. The government's push for sustainable waste management and renewable energy is a key growth driver. Demand is increasing in urban areas, particularly in states like Maharashtra and Gujarat, where waste generation is high. Regulatory frameworks are evolving to support landfill gas projects, enhancing investment opportunities in this sector.

Japan : Focus on Innovation and Sustainability

Japan's landfill gas market is valued at 200.0 million, characterized by advanced technology adoption. The country is focusing on innovative waste management solutions, driven by a strong regulatory framework promoting renewable energy. Demand is particularly high in urban centers like Tokyo and Osaka, where waste management is critical. The competitive landscape includes major players like Veolia and SUEZ, who are investing in local projects to enhance efficiency and sustainability.

South Korea : Sustainable Practices in Waste Management

South Korea's landfill gas market is valued at 150.0 million, supported by robust government policies aimed at reducing landfill waste. The country is witnessing a shift towards sustainable waste management practices, with increasing demand for landfill gas as a renewable energy source. Key cities like Seoul and Busan are leading the way in implementing innovative waste-to-energy projects, attracting significant investments from major players like Engie and Republic Services.

Malaysia : Landfill Gas as a Sustainable Solution

Malaysia's landfill gas market is valued at 60.0 million, reflecting a growing interest in renewable energy solutions. The government is actively promoting landfill gas projects as part of its commitment to sustainable development. Demand is rising in urban areas, particularly in Selangor and Penang, where waste management challenges are prevalent. The competitive landscape includes local and international players, focusing on innovative technologies to enhance efficiency.

Thailand : Government Support for Waste Management

Thailand's landfill gas market is valued at 40.0 million, with significant potential for growth. The government is implementing policies to promote renewable energy and improve waste management practices. Demand is increasing in urban areas like Bangkok, where waste generation is high. The competitive landscape includes both local and international players, focusing on developing landfill gas projects to meet the growing energy needs of the country.

Indonesia : Focus on Sustainable Development Goals

Indonesia's landfill gas market is valued at 30.0 million, with emerging opportunities in waste-to-energy solutions. The government is prioritizing sustainable development, promoting landfill gas projects to address waste management challenges. Key cities like Jakarta are witnessing increased demand for renewable energy sources. The competitive landscape includes local firms and international players, focusing on innovative technologies to enhance landfill gas utilization.

Rest of APAC : Varied Market Dynamics and Growth Potential

The Rest of APAC landfill gas market is valued at 10.0 million, showcasing diverse opportunities across various sub-regions. Each area presents unique challenges and growth drivers, influenced by local regulations and market conditions. Demand for landfill gas is gradually increasing as governments focus on sustainable waste management practices. The competitive landscape includes a mix of local and international players, each adapting to regional dynamics to capture market share.