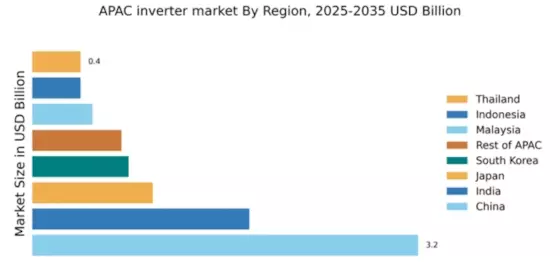

China : Unmatched Growth and Innovation

China holds a commanding 3.2% market share in the APAC inverter market, driven by rapid industrialization and a strong push for renewable energy. Government initiatives, such as the 14th Five-Year Plan, emphasize solar energy adoption, fostering demand for inverters. The increasing consumption of solar energy in urban areas, coupled with significant investments in infrastructure, positions China as a leader in this sector. Regulatory support and incentives further enhance market growth, making it a hotspot for inverter technology.

India : Strong Demand and Policy Support

India's inverter market is valued at 1.8%, fueled by a growing emphasis on solar energy and government initiatives like the Solar Rooftop Scheme. The demand for inverters is surging, particularly in states like Gujarat and Rajasthan, where solar installations are booming. The government's push for renewable energy, along with favorable policies, is driving consumption patterns towards sustainable solutions. Infrastructure development, especially in rural areas, is also enhancing market accessibility.

Japan : A Leader in Quality and Efficiency

Japan's inverter market accounts for 1.0% of the APAC total, characterized by high-quality standards and technological advancements. The government’s Feed-in Tariff (FiT) program has significantly boosted solar energy adoption, leading to increased demand for efficient inverters. Urban areas like Tokyo and Osaka are key markets, where consumers prioritize advanced technology. The competitive landscape features major players like TMEIC and local firms, driving innovation and efficiency in inverter solutions.

South Korea : Government Initiatives Drive Demand

South Korea holds a 0.8% share in the inverter market, supported by government policies promoting renewable energy. The Green New Deal initiative aims to increase solar energy capacity, driving demand for inverters. Key cities like Seoul and Busan are witnessing a rise in solar installations, enhancing consumption patterns. The market is competitive, with significant players like Samsung and LG, focusing on innovative solutions tailored to local needs and preferences.

Malaysia : Investment in Renewable Energy

Malaysia's inverter market is valued at 0.5%, with increasing investments in solar energy infrastructure. The government’s Renewable Energy Act encourages solar adoption, leading to a rise in inverter demand. Key markets include Selangor and Penang, where industrial and residential sectors are embracing solar solutions. The competitive landscape features both local and international players, fostering a dynamic environment for innovation and growth in the inverter sector.

Thailand : Inverters for Sustainable Development

Thailand's inverter market, valued at 0.4%, is experiencing growth driven by the government’s Power Development Plan, which emphasizes renewable energy. Key regions like Bangkok and Chiang Mai are seeing increased solar installations, enhancing demand for inverters. The market is competitive, with local firms and international players like SolarEdge establishing a presence. The focus on sustainable development is shaping consumption patterns and driving innovation in inverter technology.

Indonesia : Inverters for Diverse Applications

Indonesia's inverter market, also at 0.4%, is growing as the government promotes renewable energy through initiatives like the National Energy Policy. Key markets include Jakarta and Bali, where solar energy adoption is increasing. The competitive landscape features both local and international players, with a focus on affordable and efficient solutions. The diverse applications of inverters in residential, commercial, and industrial sectors are driving market dynamics and growth.

Rest of APAC : Inverter Growth Beyond Major Players

The Rest of APAC accounts for a 0.74% market share in inverters, showcasing diverse opportunities across various countries. Emerging markets are increasingly adopting solar energy, driven by local government initiatives and international investments. Countries like Vietnam and the Philippines are key players, with growing demand for efficient inverter solutions. The competitive landscape is varied, with both local and The inverter market share, fostering innovation and tailored solutions for unique regional needs.