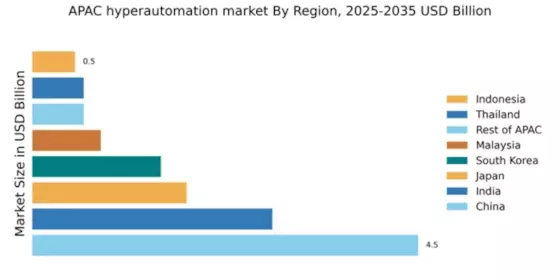

China : Rapid Growth and Innovation Hub

China holds a commanding 4.5% market share in the hyperautomation in-security sector, driven by robust investments in AI and machine learning technologies. The government's push for digital transformation and smart city initiatives has spurred demand for automation solutions. Regulatory frameworks are increasingly supportive, fostering innovation while ensuring data security. Infrastructure development, particularly in tech hubs like Shenzhen and Beijing, enhances the market's growth potential.

India : Innovation and Investment Surge

Key markets include Bengaluru, Hyderabad, and Pune, where numerous tech startups and established firms operate. Major players like UiPath and Automation Anywhere have a significant presence, intensifying competition. The local business environment is characterized by a mix of traditional industries and modern tech firms, with applications spanning finance, healthcare, and manufacturing.

Japan : Strong Focus on Cybersecurity

Tokyo and Osaka are key markets, hosting major corporations and tech firms. The competitive landscape features players like IBM and Pega Systems, who are well-established in the region. The business environment is characterized by a blend of traditional practices and modern technological adoption, with significant applications in automotive and electronics industries.

South Korea : Strong Market with Diverse Applications

Seoul and Busan are pivotal markets, with a concentration of tech firms and startups. Major players like Automation Anywhere and ServiceNow are actively competing in this landscape. The local business environment is dynamic, with a strong emphasis on R&D and collaboration between industries, leading to diverse applications in smart manufacturing and public safety.

Malaysia : Strategic Location and Investment

Kuala Lumpur and Penang are key markets, hosting numerous tech companies and startups. The competitive landscape includes players like Kofax and UiPath, who are expanding their presence. The local business environment is conducive to innovation, with applications in e-commerce, manufacturing, and public services.

Thailand : Focus on Digital Transformation

Bangkok and Chiang Mai are key markets, with a growing number of tech startups and established firms. Major players like UiPath and Automation Anywhere are gaining traction in this competitive landscape. The local business environment is characterized by a mix of traditional industries and modern tech firms, with applications in tourism, finance, and logistics.

Indonesia : Focus on Digital Innovation

Jakarta and Surabaya are key markets, with a burgeoning startup ecosystem and increasing foreign investment. Major players like Automation Anywhere and UiPath are establishing a presence in this competitive landscape. The local business environment is dynamic, with applications spanning retail, finance, and logistics.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam and the Philippines, where local players and international firms are competing. The competitive landscape features a mix of established companies and emerging startups. The business environment varies significantly, with applications in sectors like agriculture, finance, and healthcare.