Rising Cybersecurity Threats

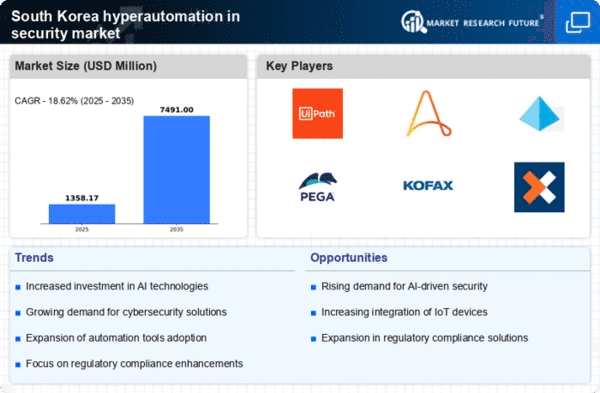

The hyperautomation in-security market is experiencing a surge due to the increasing frequency and sophistication of cyber threats in South Korea. Organizations are compelled to adopt advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting South Korean firms to invest heavily in hyperautomation technologies. This trend indicates a growing recognition of the need for automated solutions that can respond to threats in real-time, thereby enhancing overall security posture. As a result, the demand for hyperautomation in-security market solutions is likely to escalate, driven by the necessity to mitigate risks associated with cyberattacks.

Need for Operational Efficiency

Organizations in South Korea are increasingly focused on achieving operational efficiency, which is driving the adoption of hyperautomation in the security market. By automating routine security tasks, companies can reduce human error, lower operational costs, and allocate resources more effectively. In 2025, it is projected that organizations could save up to 25% in operational costs by implementing hyperautomation solutions. This emphasis on efficiency is likely to encourage more businesses to invest in automated security technologies, thereby expanding the hyperautomation in-security market. The potential for improved productivity and streamlined operations presents a compelling case for organizations to embrace these innovative solutions.

Government Initiatives and Funding

The South Korean government is actively promoting the adoption of hyperautomation technologies within the security sector. Initiatives aimed at enhancing national cybersecurity infrastructure are being implemented, with significant funding allocated to support research and development in this area. In 2025, government investments in cybersecurity are projected to reach approximately $1.5 billion, fostering innovation and encouraging private sector participation. This supportive environment is likely to stimulate growth in the hyperautomation in-security market, as companies seek to align with government standards and leverage available resources. The collaboration between public and private sectors may lead to the development of cutting-edge solutions that address emerging security challenges.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the hyperautomation in-security market in South Korea. These technologies enable organizations to analyze vast amounts of data, identify patterns, and predict potential security threats with greater accuracy. By 2025, it is anticipated that AI-driven security solutions will account for over 30% of the total market share in South Korea. This shift towards intelligent automation not only enhances threat detection capabilities but also streamlines incident response processes. As businesses increasingly recognize the value of AI and ML in enhancing security measures, the demand for hyperautomation solutions is expected to grow significantly.

Growing Demand for Compliance and Risk Management

As regulatory requirements become more stringent in South Korea, organizations are increasingly seeking solutions that ensure compliance and effective risk management. The hyperautomation in-security market is poised to benefit from this trend, as automated systems can help organizations adhere to regulations while minimizing risks. In 2025, it is estimated that compliance-related costs could account for up to 15% of total operational expenses for businesses. Consequently, the demand for hyperautomation solutions that facilitate compliance and enhance risk management strategies is likely to rise. This growing focus on regulatory adherence may drive innovation within the hyperautomation in-security market, as companies strive to develop solutions that meet evolving compliance standards.