Increased Cyber Threats

The hyperautomation in-security market is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Organizations are increasingly recognizing the necessity of advanced security measures to protect sensitive data and infrastructure. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a shift towards hyperautomation solutions that can enhance threat detection and response capabilities. This market is projected to grow at a CAGR of 25% from 2025 to 2030, driven by the need for automated security processes that can adapt to evolving threats. As companies seek to mitigate risks, investments in hyperautomation technologies are likely to increase, further propelling the market forward.

Regulatory Compliance Pressures

The hyperautomation in-security market is being shaped by increasing regulatory compliance pressures faced by organizations. With the introduction of stringent data protection laws and industry regulations, businesses are compelled to adopt automated solutions that ensure compliance and mitigate risks. In 2025, it is anticipated that compliance-related costs will account for approximately 15% of total IT budgets. This trend underscores the importance of hyperautomation technologies in facilitating compliance through automated reporting, monitoring, and auditing processes. As organizations navigate complex regulatory landscapes, the demand for hyperautomation solutions that simplify compliance management is likely to grow, further driving market expansion.

Demand for Operational Efficiency

The hyperautomation in-security market is significantly influenced by the growing demand for operational efficiency within organizations. Businesses are striving to streamline their security operations to reduce costs and improve response times. By automating repetitive tasks, organizations can allocate resources more effectively, allowing security teams to focus on strategic initiatives. In 2025, it is projected that companies will save up to 30% in operational costs by implementing hyperautomation solutions. This trend indicates a shift towards integrating automation into security frameworks, enhancing overall productivity and effectiveness. As organizations continue to prioritize efficiency, the hyperautomation in-security market is expected to expand rapidly, with a focus on innovative solutions that drive performance.

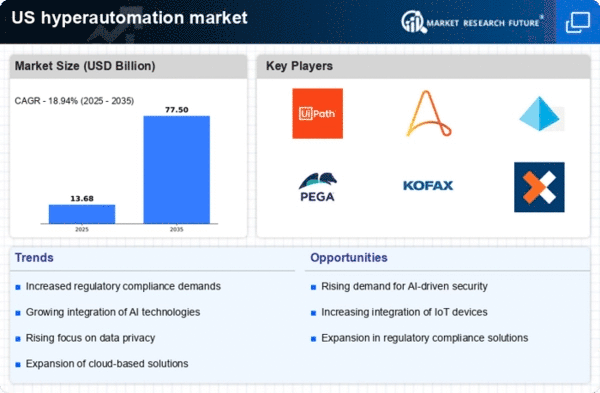

Shift Towards Cloud-Based Solutions

The hyperautomation in-security market is experiencing a notable shift towards cloud-based security solutions. Organizations are increasingly adopting cloud technologies to enhance scalability, flexibility, and accessibility of security services. By 2025, it is projected that over 60% of security solutions will be deployed in the cloud, reflecting a growing preference for cloud-native architectures. This transition allows for seamless integration of hyperautomation tools, enabling organizations to respond swiftly to security incidents. As businesses seek to leverage the benefits of cloud computing, the hyperautomation in-security market is likely to expand, driven by the demand for innovative, scalable security solutions that can adapt to changing environments.

Integration of Advanced Technologies

The hyperautomation in-security market is witnessing a trend towards the integration of advanced technologies such as artificial intelligence, machine learning, and data analytics. These technologies enhance the capabilities of security systems, enabling real-time threat detection and response. In 2025, it is estimated that AI-driven security solutions will account for over 40% of the market share, reflecting a significant shift towards intelligent automation. This integration not only improves security posture but also allows organizations to leverage data for predictive analytics, enhancing decision-making processes. As the demand for sophisticated security solutions increases, the hyperautomation in-security market is expected to evolve, driven by technological advancements.