Rising Cybersecurity Threats

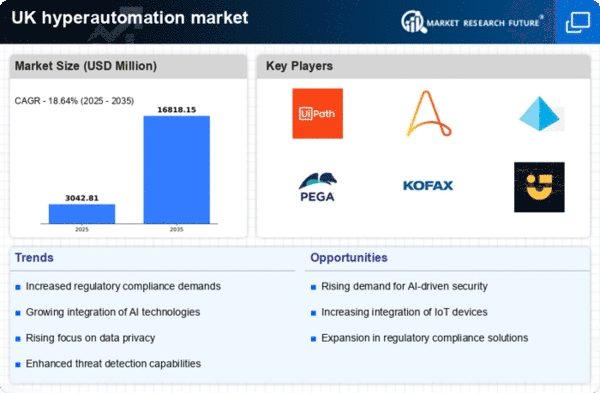

The hyperautomation in-security market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. In the UK, cybercrime incidents have escalated, with reports indicating a rise of over 30% in attacks targeting businesses in the last year alone. This alarming trend compels organizations to adopt hyperautomation solutions that enhance their security posture. By automating threat detection and response processes, companies can mitigate risks more effectively. The integration of advanced technologies such as AI and machine learning within hyperautomation frameworks allows for real-time analysis and quicker incident resolution. As businesses strive to protect sensitive data and maintain customer trust, the hyperautomation in-security market is poised for substantial growth, driven by the urgent need for robust cybersecurity measures.

Regulatory Compliance Pressures

The hyperautomation in-security market is influenced by increasing regulatory compliance pressures faced by organizations in the UK. With stringent data protection laws such as the General Data Protection Regulation (GDPR) and the Data Protection Act, businesses are compelled to implement robust security measures. Non-compliance can result in hefty fines, reaching up to £17.5 million or 4% of annual global turnover, whichever is higher. As a result, companies are turning to hyperautomation solutions to ensure compliance with these regulations. By automating compliance monitoring and reporting processes, organizations can reduce the risk of violations and enhance their overall security posture. This trend indicates a growing recognition of the importance of integrating compliance into security strategies, thereby driving the demand for hyperautomation in the security market.

Integration of Advanced Technologies

The hyperautomation in-security market is being propelled by the integration of advanced technologies such as AI, machine learning, and big data analytics. These technologies enable organizations to automate complex security processes, enhancing their ability to detect and respond to threats. In the UK, businesses are increasingly adopting hyperautomation solutions that leverage these technologies to improve their security frameworks. For instance, AI-driven analytics can identify patterns and anomalies in vast amounts of data, allowing for quicker threat identification. This trend is indicative of a broader shift towards more intelligent security systems that can adapt to evolving threats. As organizations seek to enhance their security capabilities, the integration of advanced technologies within the hyperautomation in-security market is expected to drive innovation and growth.

Demand for Real-Time Threat Intelligence

The hyperautomation in-security market is witnessing a heightened demand for real-time threat intelligence capabilities. Organizations in the UK are increasingly aware that timely access to threat data is crucial for effective incident response. The ability to automate the collection and analysis of threat intelligence allows security teams to stay ahead of potential attacks. This trend is underscored by the fact that 60% of UK businesses report that they have experienced a cyber incident in the past year, highlighting the urgency for proactive security measures. Hyperautomation solutions that integrate threat intelligence feeds can enhance situational awareness and enable faster decision-making. As the landscape of cyber threats continues to evolve, the need for real-time insights is likely to drive growth in the hyperautomation in-security market, as organizations seek to bolster their defenses.

Cost Efficiency and Resource Optimization

In the hyperautomation in-security market, organizations are increasingly recognizing the potential for cost savings and resource optimization. By automating repetitive security tasks, companies can reduce operational costs by up to 25%, allowing them to allocate resources more strategically. The UK market is witnessing a shift towards hyperautomation solutions that streamline security operations, enabling teams to focus on higher-value activities. This trend is particularly relevant as businesses face budget constraints while striving to enhance their security frameworks. Furthermore, the ability to integrate various security tools into a cohesive hyperautomation strategy can lead to improved efficiency and reduced redundancies. As organizations seek to balance cost management with effective security measures, the hyperautomation in-security market is likely to expand, driven by the demand for more efficient security operations.