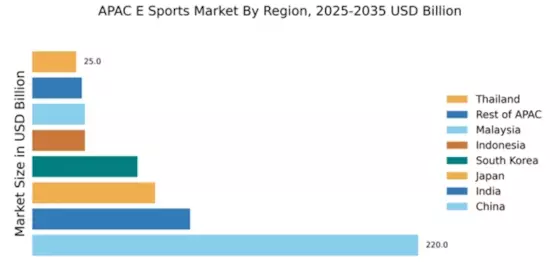

China : Unmatched Growth and Investment

China holds a staggering market share of 220.0 million in the esports sector, representing a significant portion of the APAC market. Key growth drivers include a robust gaming culture, increasing internet penetration, and government support for digital entertainment. The demand for competitive gaming is surging, fueled by youth engagement and the rise of mobile gaming. Regulatory policies are becoming more favorable, with initiatives aimed at promoting esports as a legitimate industry, enhancing infrastructure and investment in gaming hubs.

India : Youth Engagement Fuels Growth

India's esports market is valued at 90.0 million, showcasing a rapid growth trajectory. The key drivers include a young population, increasing smartphone usage, and a burgeoning internet user base. Demand trends indicate a shift towards mobile esports, with local tournaments gaining popularity. Government initiatives are also promoting digital sports, while infrastructure improvements are enhancing connectivity and access to gaming platforms.

Japan : Blending Tradition with Modernity

Japan's esports market is valued at 70.0 million, characterized by a unique blend of traditional gaming culture and modern esports. Key growth drivers include the popularity of console gaming and a strong presence of local developers. Demand trends show a growing interest in competitive gaming events, supported by government initiatives to promote esports as a cultural export. Infrastructure development is also on the rise, with venues being established for major tournaments.

South Korea : Legacy of Competitive Gaming

South Korea's esports market, valued at 60.0 million, is renowned for its competitive gaming legacy. The growth is driven by a strong gaming culture, high-speed internet access, and significant investment from both private and public sectors. Demand trends indicate a preference for PC gaming, with major tournaments attracting global audiences. The government actively supports esports through funding and infrastructure development, fostering a vibrant ecosystem for gamers and developers alike.

Malaysia : Diverse Gaming Community Thrives

Malaysia's esports market is valued at 30.0 million, reflecting a growing interest in competitive gaming. Key growth drivers include a diverse gaming community and increasing participation in local tournaments. Demand trends show a rise in mobile gaming, with government initiatives promoting esports as a viable career path. Infrastructure improvements, including gaming arenas and internet connectivity, are enhancing the overall gaming experience.

Thailand : Youth-Driven Market Dynamics

Thailand's esports market, valued at 25.0 million, is characterized by a vibrant gaming community. The growth is driven by youth engagement and increasing access to gaming platforms. Demand trends indicate a rise in mobile esports, with local tournaments gaining traction. Government initiatives are supporting the esports ecosystem, while infrastructure development is improving connectivity and access to gaming resources.

Indonesia : Youth Engagement and Mobile Gaming

Indonesia's esports market is valued at 30.0 million, showcasing rapid growth driven by a young population and increasing smartphone penetration. Demand trends indicate a strong preference for mobile gaming, with local tournaments becoming increasingly popular. Government initiatives are promoting esports as a legitimate industry, while infrastructure improvements are enhancing access to gaming platforms and events.

Rest of APAC : Emerging Markets and Growth Potential

The Rest of APAC esports market is valued at 28.27 million, reflecting diverse opportunities across various countries. Key growth drivers include increasing internet access and a growing youth demographic interested in gaming. Demand trends show a rise in local tournaments and community engagement. Government initiatives are fostering a supportive environment for esports, while infrastructure development is enhancing connectivity and access to gaming resources.