China : Leading in Innovation and Adoption

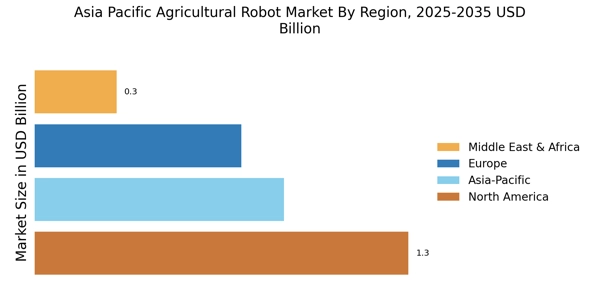

Key markets include provinces like Shandong and Henan, known for their agricultural output. The competitive landscape features major players such as John Deere and Kubota, who are investing heavily in R&D and local partnerships. The business environment is favorable, with increasing investments in agri-tech startups. Specific applications include crop monitoring and autonomous harvesting, which are gaining traction among local farmers seeking efficiency and sustainability.

India : Transforming Traditional Farming Practices

Key markets include states like Punjab and Haryana, which are major agricultural producers. The competitive landscape features players like AG Leader Technology and Trimble, who are expanding their presence through collaborations with local firms. The business environment is evolving, with increasing investments in agri-tech and a focus on sector-specific applications such as soil health monitoring and crop management. Local farmers are increasingly adopting these technologies to enhance productivity.

Japan : Pioneering Robotics in Farming

Key markets include regions like Hokkaido and Kumamoto, known for their agricultural diversity. The competitive landscape features major players like Yamaha Motor and Kubota, who are leading in research and development. The business environment is characterized by a strong focus on quality and efficiency, with applications in rice cultivation and fruit harvesting. Local farmers are increasingly adopting robotics to maintain competitiveness in a challenging market.

South Korea : Adapting Robotics for Efficiency

Key markets include Gyeonggi-do and Jeollanam-do, which are significant agricultural regions. The competitive landscape features players like CNH Industrial and Harvest Automation, who are investing in local partnerships. The business environment is favorable, with increasing investments in agri-tech startups. Specific applications include automated planting and crop monitoring, which are gaining traction among local farmers seeking to improve yields and reduce labor costs.

Malaysia : Modernizing Agriculture for Sustainability

Key markets include states like Selangor and Johor, known for their agricultural output. The competitive landscape features players like EcoRobotix, who are expanding their presence through collaborations with local firms. The business environment is evolving, with increasing investments in agri-tech and a focus on sector-specific applications such as palm oil cultivation and crop monitoring. Local farmers are increasingly adopting these technologies to enhance productivity and sustainability.

Thailand : Enhancing Efficiency in Farming

Key markets include provinces like Chachoengsao and Nakhon Ratchasima, which are significant agricultural regions. The competitive landscape features players like Trimble and Naio Technologies, who are investing in local partnerships. The business environment is favorable, with increasing investments in agri-tech startups. Specific applications include automated irrigation and crop monitoring, which are gaining traction among local farmers seeking to improve efficiency and reduce costs.

Indonesia : Transforming Agriculture with Technology

Key markets include regions like West Java and Central Java, known for their agricultural output. The competitive landscape features players like John Deere and Harvest Automation, who are expanding their presence through collaborations with local firms. The business environment is evolving, with increasing investments in agri-tech and a focus on sector-specific applications such as rice cultivation and crop management. Local farmers are increasingly adopting these technologies to enhance productivity and sustainability.

Rest of APAC : Niche Markets Emerging Across Region

Key markets include emerging economies like Vietnam and the Philippines, where agriculture plays a crucial role. The competitive landscape features a mix of local and international players, creating a dynamic business environment. Specific applications include automated planting and crop monitoring, which are gaining traction among local farmers seeking to improve efficiency and reduce labor costs. The region is witnessing a gradual shift towards modern agricultural practices.