Technological Advancements

Technological advancements play a pivotal role in shaping the Articulated Robot Market Products Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of articulated robots, making them more versatile and efficient. For instance, the introduction of collaborative robots, or cobots, allows for safer human-robot interaction, which is increasingly favored in manufacturing settings. The market for these advanced robots is expected to witness a significant uptick, with projections indicating a growth rate of around 15% annually. This evolution in technology not only improves operational efficiency but also expands the application range of articulated robots, thereby driving market growth.

Rising Demand for Automation

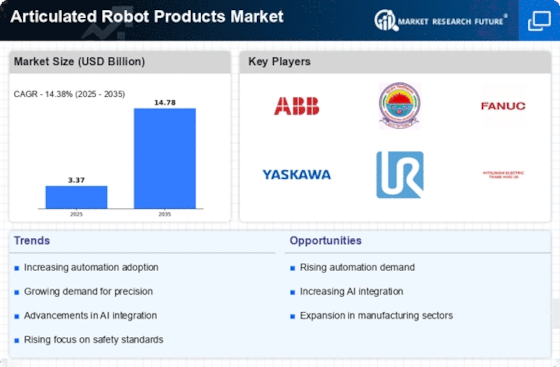

The Articulated Robot Market Products Market is experiencing a notable surge in demand for automation across various sectors. Industries such as automotive, electronics, and consumer goods are increasingly adopting articulated robots to enhance productivity and efficiency. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the need for precision, speed, and the ability to operate in hazardous environments, which articulated robots can effectively address. As companies strive to remain competitive, the integration of these robots into production lines is becoming a strategic imperative, thereby propelling the growth of the articulated robot products market.

Labor Shortages and Skills Gap

The Articulated Robot Market Products Market is significantly influenced by the ongoing labor shortages and skills gap in various sectors. As industries face challenges in finding skilled labor, the adoption of articulated robots becomes a viable solution to mitigate these issues. The increasing difficulty in hiring qualified personnel has led companies to invest in automation technologies, with articulated robots serving as a key component in addressing labor inefficiencies. Reports suggest that nearly 70% of manufacturers are considering automation to counteract labor shortages, which is likely to bolster the demand for articulated robots. This trend indicates a shift towards a more automated workforce, further propelling the growth of the articulated robot products market.

Growing Adoption in Logistics and Warehousing

The Articulated Robot Market Products Market is witnessing a growing adoption of articulated robots in logistics and warehousing sectors. As e-commerce continues to expand, the demand for efficient and reliable logistics solutions is increasing. Articulated robots are being utilized for tasks such as picking, packing, and sorting, which enhances operational efficiency and reduces labor costs. Recent statistics indicate that the logistics automation market is projected to grow at a rate of 12% annually, with articulated robots playing a crucial role in this transformation. This trend not only streamlines operations but also addresses the challenges posed by increasing order volumes, thereby driving the growth of the articulated robot products market.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Articulated Robot Market Products Market. Companies are allocating substantial resources to innovate and improve robotic technologies, which is essential for maintaining competitive advantage. This focus on R&D is leading to the development of more sophisticated and capable articulated robots that can perform complex tasks with greater efficiency. Data indicates that R&D spending in the robotics sector has increased by approximately 20% over the past few years, reflecting the industry's commitment to advancing robotic solutions. As new technologies emerge, the market for articulated robots is expected to expand, driven by enhanced functionalities and applications.