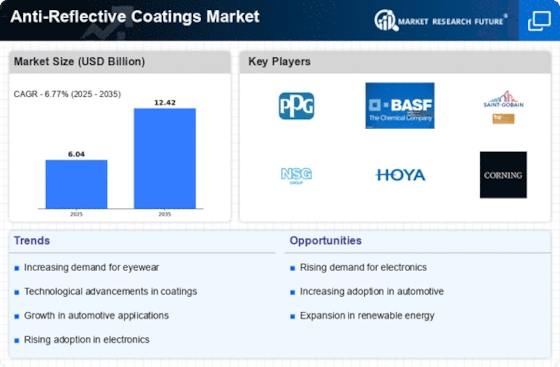

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Anti-Reflective Coatings Market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Anti-Reflective Coatingsindustry must offer cost-effective items.

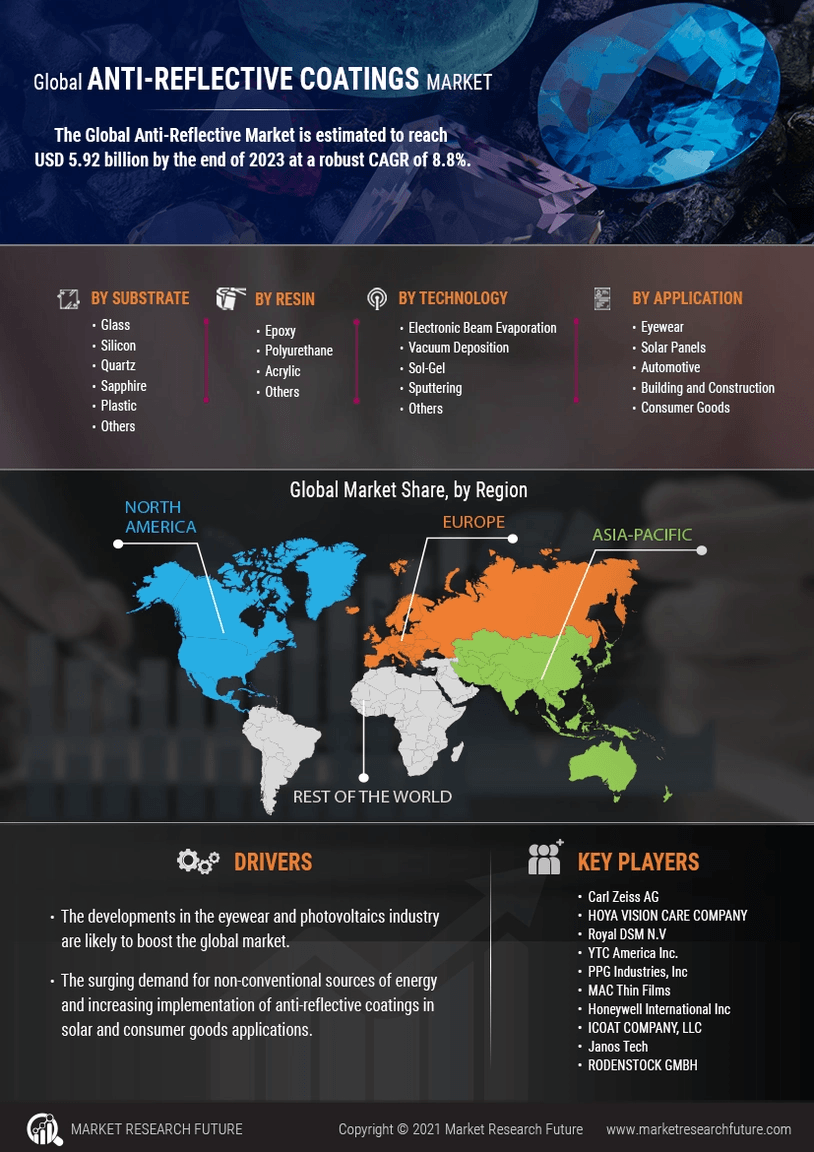

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Anti-Reflective Coatings industry to benefit clients and increase the market sector. In recent years, the Anti-Reflective Coatings industry has offered some of the most significant advantages to medicine. Major players in the Anti-Reflective Coatings Market, including PPG Industries, Inc (US), MAC Thin Films (US), Honeywell International Inc (US), ICOAT COMPANY, LLC (US), Janos Tech (US), and RODENSTOCK GMBH (Germany) and others, are attempting to increase market demand by investing in research and development operations.

VSP Vision Care (VSP) is a health insurance company that provides vision care in Australia, Canada, Ireland, the United States, and the United Kingdom. It is a doctor-led company with five divisions: "eye care insurance, high-quality eyewear, lens and lens enhancements, ophthalmic technology, and connected experiences to strengthen patients' relationships with their eye doctors." It employs around 80 million people ly and is the largest eye insurance company in the United States. In May 2020, VSP Optical Group Inc. has introduced TechShield anti-reflective coating for eyewear, which includes ISO-certified anti-bacterial technology.

The proprietary coatings are exclusively offered through VS network private-practice doctors.

Carl Zeiss AG is a German optical system and optoelectronics firm founded in Jena, Germany in 1846 by optician Carl Zeiss. He laid the groundwork for today's multinational corporation with Ernst Abbe (joined 1866) and Otto Schott (joined 1884). The current corporation arose from the 1990s consolidation period of Carl Zeiss companies in East and West Germany.

In February Carl Zeiss AG and Sony Corporation strengthened their strategic partnership to include ZEISS optics with T* anti-reflective coatings in the new Xperia smartphone, improving image quality and providing users with a fine photography experience.

According to US-based Thornova, their new panel will have a temperature coefficient of -0.29% per C in 2024 and a power conversion efficiency ranging from 22.4% to 23.2%. The business, a division of Sunova Solar, a Chinese manufacturer, is now developing a factory that will produce solar cells and modules at an undisclosed location in the United States.

Leading provider of ophthalmic lens technology, HOYA Vision Care, announced today the arrival of Super HiVision® MeiryoTM EX4TM anti-reflective treatment in the United States for 2023. As patients and eye care professionals have come to expect, the new lens treatment provides industry-leading scratch resistance, durability, and long-term cleanability in addition to full back-side UV protection.