US Anti Reflective Coatings Market Summary

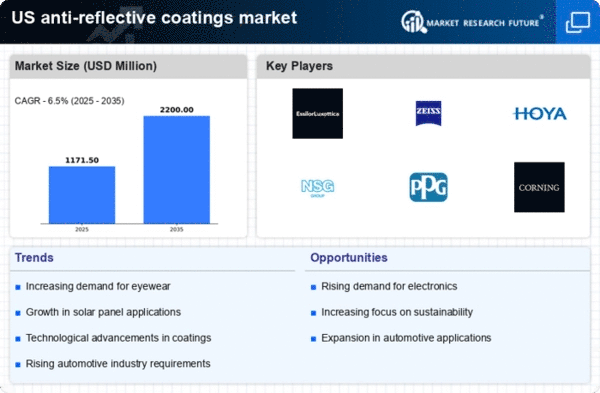

As per Market Research Future analysis, the US anti-reflective coatings market size was estimated at 1100.0 USD Million in 2024. The US anti reflective-coatings market is projected to grow from 1171.5 USD Million in 2025 to 2200.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US anti reflective-coatings market is poised for growth driven by technological advancements and diverse applications.

- Technological advancements are enhancing the performance and efficiency of anti reflective coatings across various sectors.

- The electronics segment remains the largest, while the automotive sector is emerging as the fastest-growing segment in the market.

- A strong focus on sustainability is driving innovations in anti reflective coatings, aligning with environmental goals.

- Key market drivers include the growing demand in electronics and the expansion of the optical devices market.

Market Size & Forecast

| 2024 Market Size | 1100.0 (USD Million) |

| 2035 Market Size | 2200.0 (USD Million) |

| CAGR (2025 - 2035) | 6.5% |

Major Players

EssilorLuxottica (FR), Zeiss (DE), Hoya Corporation (JP), Nippon Sheet Glass (JP), PPG Industries (US), Corning Incorporated (US), Rodenstock GmbH (DE), SABIC (SA)