Market Trends and Projections

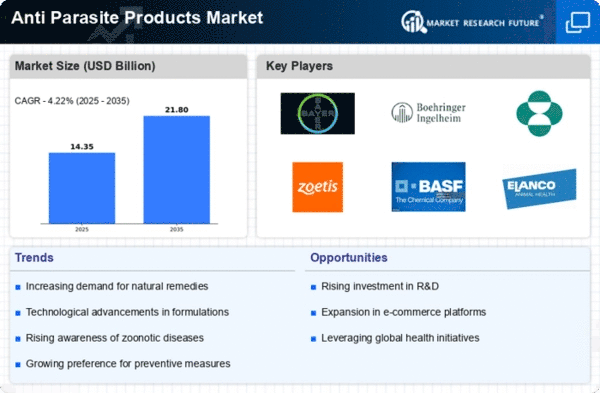

The Global Anti parasite Products Market Industry is projected to experience robust growth, with anticipated market values reaching 15.75 USD Billion in 2024 and 25 USD Billion by 2035. The compound annual growth rate is expected to be 4.29% from 2025 to 2035, indicating a steady increase in demand for anti-parasitic products. This growth is driven by various factors, including rising incidences of parasitic infections, advancements in pharmaceutical research, and increased government funding for public health initiatives.

Growing Awareness and Education

Awareness regarding the dangers posed by parasites is on the rise, significantly impacting the Global Anti parasite Products Market Industry. Educational campaigns by governments and health organizations have increased public knowledge about prevention and treatment options. For example, initiatives aimed at educating communities about the risks of parasitic infections and the importance of hygiene have led to increased demand for anti-parasitic products. This growing awareness is likely to contribute to the market's projected growth, with estimates suggesting a value of 25 USD Billion by 2035, as consumers become more proactive in seeking preventive measures.

Government Initiatives and Funding

Government initiatives aimed at combating parasitic diseases are significantly influencing the Global Anti parasite Products Market Industry. Increased funding for research, public health campaigns, and distribution of anti-parasitic medications are pivotal in addressing the global burden of these infections. For instance, various countries have implemented national programs to provide free or subsidized anti-parasitic treatments to vulnerable populations. Such initiatives not only enhance accessibility but also stimulate market growth, as they create a conducive environment for the development and distribution of anti-parasitic products.

Expansion of Veterinary Applications

The Global Anti parasite Products Market Industry is also witnessing growth due to the expansion of veterinary applications. The rising awareness of animal health and the economic impact of parasitic infections in livestock and pets are driving demand for anti-parasitic products in veterinary medicine. For example, the use of anti-parasitic treatments in livestock has been shown to improve productivity and reduce economic losses. This trend is likely to contribute to the overall market growth, as the veterinary sector increasingly recognizes the importance of effective anti-parasitic solutions.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are propelling the Global Anti parasite Products Market Industry forward. The development of new drugs and formulations that target specific parasites is enhancing treatment efficacy and safety. For example, recent studies have yielded novel compounds that show promise against resistant strains of parasites. This continuous research and development effort is expected to sustain a compound annual growth rate of 4.29% from 2025 to 2035, as the industry adapts to emerging challenges in parasitic infections and strives to provide effective solutions.

Rising Incidence of Parasitic Infections

The Global Anti parasite Products Market Industry is experiencing growth due to the increasing prevalence of parasitic infections worldwide. Factors such as urbanization, climate change, and global travel contribute to the spread of parasites, leading to a heightened demand for effective anti-parasitic treatments. For instance, the World Health Organization reports that millions are affected by diseases like malaria and schistosomiasis annually. This rising incidence is expected to drive the market value to approximately 15.75 USD Billion in 2024, as healthcare systems prioritize the development and distribution of anti-parasitic products to combat these infections.