Rising Incidence of Counterfeiting

The rising incidence of counterfeiting across various industries is a critical driver for the Anti Counterfeit Packaging Market. As counterfeit products become more sophisticated, the need for effective anti-counterfeit measures intensifies. Reports indicate that the global economic impact of counterfeiting could reach trillions of dollars, prompting manufacturers to invest in advanced packaging solutions. This trend is particularly evident in the electronics and automotive sectors, where counterfeit products can pose serious safety risks. Consequently, companies are increasingly adopting innovative packaging technologies to safeguard their products and maintain consumer trust, thereby driving market growth.

Regulatory Compliance and Standards

Regulatory compliance and standards play a crucial role in shaping the Anti Counterfeit Packaging Market. Governments and regulatory bodies are increasingly implementing stringent regulations to combat counterfeiting, particularly in sectors like electronics and automobiles. Compliance with these regulations often necessitates the adoption of advanced packaging solutions that ensure product integrity and authenticity. For example, the introduction of mandatory labeling requirements for electronic products has led to a surge in demand for anti-counterfeit packaging. This trend is expected to continue, as companies strive to meet regulatory standards while protecting their brand reputation and consumer trust.

Integration of Advanced Technologies

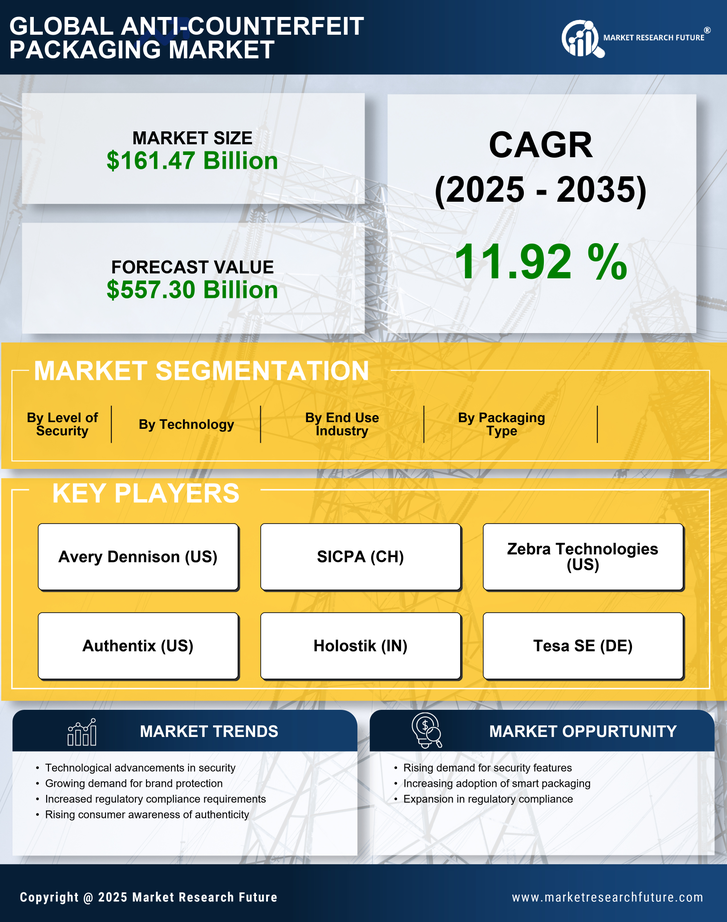

The integration of advanced technologies such as RFID, QR codes, and blockchain is a pivotal driver in the Anti Counterfeit Packaging Market. These technologies enhance traceability and authentication, allowing manufacturers to verify the legitimacy of their products. For instance, RFID tags can be embedded in packaging, enabling real-time tracking and monitoring throughout the supply chain. This technological advancement not only deters counterfeiters but also instills confidence in consumers regarding product authenticity. As the demand for secure packaging solutions rises, the market for anti-counterfeit technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years.

Consumer Awareness and Demand for Authenticity

Consumer awareness regarding the risks associated with counterfeit products is a significant driver in the Anti Counterfeit Packaging Market. As consumers become more educated about the potential dangers of counterfeit electronics and automobiles, their demand for authentic products increases. This heightened awareness has led to a shift in purchasing behavior, with consumers actively seeking products that guarantee authenticity. Market Research Future indicates that approximately 70% of consumers are willing to pay a premium for products that come with anti-counterfeit packaging. This trend not only benefits manufacturers who invest in secure packaging solutions but also fosters a competitive market environment focused on quality and authenticity.

Technological Advancements in Packaging Solutions

Technological advancements in packaging solutions are transforming the Anti Counterfeit Packaging Market. Innovations such as holograms, tamper-evident seals, and digital watermarks are being integrated into packaging designs to enhance security and deter counterfeiting. These advancements not only provide a visual assurance of authenticity but also enable consumers to verify the legitimacy of products easily. The market for these advanced packaging solutions is expected to expand, with projections indicating a growth rate of over 12% annually. As manufacturers continue to seek ways to differentiate their products in a competitive landscape, the adoption of cutting-edge packaging technologies will likely remain a key focus.