Research Methodology on Vehicle Anti-Theft Market

Introduction

The growth of the global vehicle anti-theft market is mainly driven by the growing concern for vehicle safety, technological advancements, stringent government norms, and rising vehicle thefts. The increasing rate of vehicle thefts and the need for access control laws have also provided an impetus to market growth.

The global vehicle anti-theft market is estimated to grow at a rapid pace during the forecast period (2023-2032). To evaluate the current data and trends in the market, comprehensive research is carried out and the collected data is studied and analysed by the Market Research Future (MRFR) team.

Objectives

The following are the objectives of the research:

- To gain an in-depth understanding of the global vehicle anti-theft market and its drivers.

- To provide an overview of the major players present in the market and their respective market shares.

- To analyze the regional trends in the global vehicle anti-theft market.

Research Methodology

A comprehensive research methodology is used to accurately gather and analyze the required data and provide an overview of the global vehicle anti-theft market and its drivers. Secondary data is used, including research papers and reports, to accumulate accurate insights and analysis. Data from various sources is gathered to obtain a market size; Company websites, business reports, and annual account statements, amongst other sources, are referred to gain information about the market and its players.

Primary Research

Primary research data and interviews are incorporated to provide a deeper understanding of the global vehicle anti-theft market and its dynamics. Key industry players have been contacted and interviewed to understand the prevailing market conditions and their outlook. Primary research data to gain insight into the dynamics of the market, such as drivers, restraints, and opportunities, are used to gain a thorough understanding of the market. Qualitative and quantitative methodologies are applied to accurately measure the market size and analyse market trends, segments, and growth opportunities.

Market Segmentation

The global vehicle anti-theft market is segmented based on vehicle types, technologies, solutions, and regions.

- By Vehicle Types: Passenger Vehicles, Two-Wheelers

- By Technologies: Engine Immobilizer, GPS, RFID, Others

- By Solution Type: Sensors, Alarms & Security Warning Systems, Others

- By Region: North America, Europe, Asia Pacific, and Rest-of-the-World

Data Collection & Analysis

Data collected from various sources is collated, cleaned, and validated to generate an accurate market size. Top-down and bottom-up approaches have been used, along with the total addressable market (TAM) and the market opportunity analysis (MOA) frameworks, to calculate the market size. Secondary and primary research data have been carefully analysed to gain an understanding of the market and to draw meaningful insights.

Data validation & Triangulation

Data is triangulated methodologically and graphically so as to provide an accurate interpretation of the current and future market conditions. Data points collected have been cross-validated for accuracy and further validated through primary sources during interviews.

Geo-Analysis

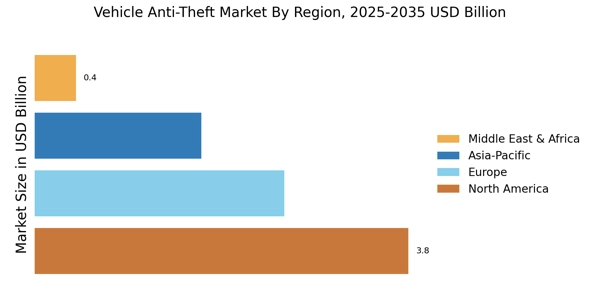

The global vehicle anti-theft market has been analysed across four major geographies—North America, Europe, Asia-Pacific, and Rest-of-the-World.

Key Players

The MRFR team has identified the key players in the global vehicle anti-theft market and interviewed them to gain precise insight into their products, strategies, and outlook. The list of key players includes Continental AG, THACHER, Autoliv Inc., Aisin Seiki Co. Ltd., Robert Bosch GmbH, STONKAM Co. Ltd., HanBang Co. Ltd., China Automobile Electronic Co. Ltd., to mention a few.

Conclusion

The collected data is carefully analysed to understand the dynamics of the global vehicle anti-theft market and its players. Comprehensive research methodologies are adopted to gain an in-depth understanding of the market and its drivers. Primary research data is gathered to examine the latest developments, trends, and opportunities in the market. All the collected data is collated and validated to draw precise market insights and projections.